Headlines

- 1 An Additional 33.6 Million TEU in 25 Years – A New Era of Containers Marked by a Changing Industry Leader

- 2 Global Port Throughput Surpasses 1 Billion TEU with Growth Exceeding 5% – The Heat of Global Logistics

- 3 The Dilemma of Suez Canal Resumption: Hub-Port Congestion versus a 10–14 Day Transit Time Gain

- 4 576 Containers Lost at Sea – The Reality of Safety Management under the New SOLAS Rules

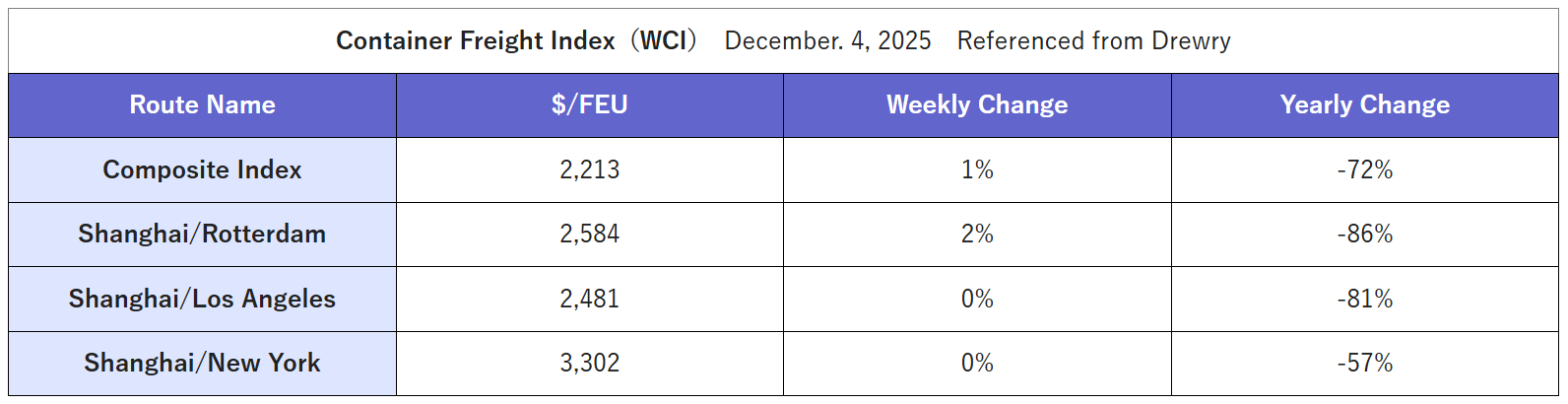

- 5 WCI at USD 2,213 – Four Consecutive Weekly Increases, Yet 72% Down Year on Year

- 6 Waves of Consolidation in Container Leasing – What the Seaco Acquisition and Triton Layoffs Reveal

- 7 Newly Built Container Information in December 2025 – Reefer Investment Accelerates Sharply

- 8 Lessons from the Film “KOKUHO” – What It Takes for Professionals to Deliver Results

An Additional 33.6 Million TEU in 25 Years – A New Era of Containers Marked by a Changing Industry Leader

The opening report of the year looks back on what kind of year 2025 was for container shipping lines, and considers what 2026 is likely to bring.

The opening report of the year looks back on what kind of year 2025 was for container shipping lines, and considers what 2026 is likely to bring.

Shipping Guide has published an article based on Alphaliner’s (France) 25-year retrospective of the container shipping industry (2000–2025), which we introduce here. Over the past 25 years, the global container fleet has expanded to 33.6 million TEU. This growth was driven by the rapid increase in the world’s population, the expansion of multimodal supply chains and just-in-time delivery, and China’s rise as a manufacturing hub following its accession to the WTO, all of which led to a sharp increase in cargo volumes on the East–West trades. At the same time, industry consolidation among shipping lines has progressed significantly, creating a highly oligopolistic market structure. The top ten carriers increased their share of total operated capacity from 61% in the early 2000s to 84%.

Alphaliner highlights five major changes over this period, i.e., (1) the jumboizing and upsizing of container ships, (2) the Change in the leading shipping line holding the largest fleet capacity, (3) the shift in the world’s largest container port, (4) global population growth, and (5) the substantial expansion of the container fleet.

Indeed, in the early 2000s the largest container vessels were Maersk’s 8,200 TEU class. Today, MSC operates the world’s largest ships at 24,346 TEU—almost three times larger. Likewise, in the early 2000s Maersk operated about 170 vessels with a total capacity of 694,054 TEU, but MSC has now taken the top position, operating 968 vessels with a total capacity of 7,099,313 TEU.

In 2000, Hong Kong was the world’s largest container port, handling 18.1 million TEU annually. Today, Shanghai has taken the top spot, boasting a handling capacity of 55.9 million TEU. Singapore has maintained its position as the world’s second-largest container port, unchanged from 2000. During this period, the global population has grown by 34%, from 6.15 billion to 8.23 billion. Alphaliner also notes that if all containers in the global fleet were placed one by one on railway wagons, their total length would have increased from 36,070 km in 2000 to 268,787 km today.

Global Port Throughput Surpasses 1 Billion TEU with Growth Exceeding 5% – The Heat of Global Logistics

This is another article cited from Shipping Guide. According to the latest report by Linerlytica, a Singapore-based maritime market research firm, global port container throughput is expected to exceed 1 billion TEU in 2025, setting a new all-time record. Despite the tariff policies of the Trump administration in the United States, container volumes are expected to continue expanding in the second half of 2025 (July–December), which would push global annual throughput above 1 billion TEU for the first time. Annual growth is projected to exceed 5.1%, driven mainly by steady container exports from China to markets other than the United States. Exports to Europe, Latin America, Africa, and India–Middle East are all performing strongly, while the U.S.–China trade dispute has also boosted container volumes in Southeast Asia. For 2026, however, growth is forecast to slow to 2.1% due to a global imbalance between supply and demand amid weakening cargo demand.

The Dilemma of Suez Canal Resumption: Hub-Port Congestion versus a 10–14 Day Transit Time Gain

On December 23, the Suez Canal Authority announced that a CMA CGM ultra-large container vessel of 23,112 TEU had transited the Suez Canal, making it the largest container ship to pass through the canal in the past two years. The Authority is urging other carriers to return to the Suez route, and expects the number of transits in 2026 to recover gradually, returning to normal levels in the second half of the year.

On December 23, the Suez Canal Authority announced that a CMA CGM ultra-large container vessel of 23,112 TEU had transited the Suez Canal, making it the largest container ship to pass through the canal in the past two years. The Authority is urging other carriers to return to the Suez route, and expects the number of transits in 2026 to recover gradually, returning to normal levels in the second half of the year.

Meanwhile, on December 19 Maersk sent a 6,500-TEU container ship through the Bab el-Mandeb Strait and into the Red Sea, but this has not yet led to a full resumption of Suez Canal transits.

PSA International, the Singapore-based terminal operator, expects that major container carriers will gradually resume transits through the Red Sea and the Suez Canal on the Asia–Europe routes in the first half of this year, as momentum builds for a return from the Cape of Good Hope diversions. As transit times would be shortened by 10 to 14 days once services resume, PSA forecasts that surplus vessel and container capacity will become more visible, leading to downward pressure on freight rates over the longer term.

However, it also warns that schedule adjustments associated with route changes will cause a temporary increase in port calls at major hub ports such as Singapore, resulting in congestion as vessels wait at anchorage. PSA sees this congestion, together with labor shortages at hub ports, as one factor that will help gradually absorb excess vessel and container capacity. As countermeasures, PSA plans to expand the Port of Singapore, improve efficiency through the use of AI, and strengthen collaboration with customers.

We are reminded of the autumn of 2021 during the COVID-19 pandemic, when between 60 and 80 vessels were queuing offshore at the Ports of Los Angeles and Long Beach, pushing average waiting times to six to eight days, and when as many as 116 container ships were stuck in and around the ports in early 2022.

576 Containers Lost at Sea – The Reality of Safety Management under the New SOLAS Rules

In May 2024, the International Maritime Organization (IMO) amended the safety of navigation provisions of the International Convention for the Safety of Life at Sea (SOLAS). Under the new rules, effective from January 1, 2026, any vessel carrying one or more containers is required to report promptly to the nearest coastal state and other relevant authorities whenever containers are confirmed to have been lost overboard.

According to the World Shipping Council (WSC), the global industry body for liner shipping, 576 containers were lost at sea in 2024, an increase from the previous year. With more services being routed via the Cape of Good Hope, around 200 of these losses—about 35% of the total—occurred in that routing.

WCI at USD 2,213 – Four Consecutive Weekly Increases, Yet 72% Down Year on Year

The composite index of Drewry’s World Container Index (WCI), released on December 25, rose by 1% week on week to USD 2,213 per FEU, marking the fourth consecutive weekly increase. However, it was down 72% compared with the same period last year. Please refer to the table for freight levels by trade lane, as well as week-on-week and year-on-year changes. Drewry expects another slight rise in rates this week and forecasts that the trans-Pacific trades will remain stable.

Waves of Consolidation in Container Leasing – What the Seaco Acquisition and Triton Layoffs Reveal

On December 15, we received an email from Seaco announcing that it will formally proceed with the acquisition of Textainer. For the time being, however, the two companies will continue to operate independently, as before. On the other hand, there is sad news. Triton’s Japan office has announced staff reductions: three of the five employees—all women—were given just two weeks’ notice and dismissed at the end of December. Is this the reality of foreign-owned companies? They had been responsible for used-container sales, but the company plans to complete this work through greater use of online platforms instead.

Newly Built Container Information in December 2025 – Reefer Investment Accelerates Sharply

Newly built container prices in December remained unchanged from the previous month at USD 1,550 per 20ft. Total production amounted to 534,479 TEU (Dry: 482,967 TEU; Reefer: 51,512 TEU). Compared with November, this represented an increase of 88,897 TEU in total (Dry: +79,707 TEU; Reefer: +9,190 TEU), or a 20% rise overall (Dry: +20%; Reefer: +22%).

Total factory inventories of newbuild containers at the end of December stood at 1,663,105 TEU (Dry: 1,599,399 TEU; Reefer: 63,706 TEU). Compared with November, this was a decrease of 16,117 TEU in total (Dry: –5,898 TEU; Reefer: –10,219 TEU), equivalent to a 1% decline overall (Dry: ±0%; Reefer: –14%).

Total factory deliveries in December amounted to 550,596 TEU (Dry: 488,865 TEU; Reefer: 61,731 TEU). Compared with November, this represented an increase of 116,645 TEU in total (Dry: +84,292 TEU; Reefer: +32,353 TEU), equivalent to a month-on-month rise of 27% overall (Dry: +21%; Reefer: +110%). Newbuild container prices remained unchanged from the previous month, as higher steel prices were offset by lower costs for flooring and paint. With total deliveries exceeding 550,000 TEU, December shipments were at a notably high level for the month.

In 2025, newbuild prices declined from USD 1,900 per 20ft in January to USD 1,550 per 20ft in December, representing a drop of USD 300, or 16%, over the year. The average newbuild price for the year was USD 1,680 per 20ft. Total newbuild container production in 2025 reached 6,414,000 TEU, comprising Dry: 5,958,000 TEU and Reefer: 456,000 TEU. This was the third-highest annual production volume of the past decade. Moreover, reefer production of 456,000 TEU was the highest in the past ten years, suggesting that both shipping lines and leasing companies are increasingly focusing their investments on Reefer containers. While much of this is likely replacement of older units, it also reflects carriers’ expectations of growing reefer slot capacity on newbuild ultra-large container ships and rising demand for reefer cargo.

Lessons from the Film “KOKUHO” – What It Takes for Professionals to Deliver Results

On Wednesday, December 31 (New Year’s Eve), I went to see the much-talked-about film “KOKUHO” (National Treasure) at 10 a.m. Although it had already been released on Friday, June 6 and more than six months had passed, only the first three rows were still available. Reluctantly, I ended up watching the movie from the third row on the right side, at an awkward angle. At first, I felt uncomfortable with the unfamiliar seat, but I was soon drawn into the film by the unfolding story, the beauty of the visuals, and the pleasant sound effects.

On Wednesday, December 31 (New Year’s Eve), I went to see the much-talked-about film “KOKUHO” (National Treasure) at 10 a.m. Although it had already been released on Friday, June 6 and more than six months had passed, only the first three rows were still available. Reluctantly, I ended up watching the movie from the third row on the right side, at an awkward angle. At first, I felt uncomfortable with the unfamiliar seat, but I was soon drawn into the film by the unfolding story, the beauty of the visuals, and the pleasant sound effects.

The characters’ relentless pursuit of perfection in their art resonated deeply with our own lives and work. I found myself empathizing with many themes—how one lives, effort, obsession, resignation, betrayal, encounters, farewells, and sorrow. As I overlaid the story onto my own life, tears flowed uncontrollably, and I could not let go of my handkerchief—perhaps a sign of my age.

The film tells a story how 50 years of time lead and rosed a Kabuki actor to become a “National Treasure.” It is the story of an outsider in the bloodline-centered world of Kabuki who devotes himself to mastering the art and ultimately achieves the status of a National Treasure of Kabuki.

Kabuki originated in the dances of a female performer named Izumo no Okuni. In its early days, Onna-Kabuki (Female Kabuki) was the mainstream, but in the early Edo period it was banned on the grounds that it disturbed public morals. This led to the birth of Onnagata—male actors specializing in female roles—a tradition that has been handed down and continues to this day as a defining feature of Kabuki.

When I watched “KOKUHO” on New Year’s Eve, a special event was also arranged. To our delight, director Lee Sang-il and the leading actors, including Ryō Yoshizawa and Ryūsei Yokohama, appeared on stage at the Kabuki-za and were broadcast live to 356 movie theaters screening KOKUHO. When the two handsome actors appeared in full makeup and kimono as Onnagata, it was honestly impossible to tell them apart. Director Lee even remarked that Yoshizawa’s bewitching presence—combining beauty with a sense of emptiness—made KOKUHO a film that was “destined to be made.” Indeed, many in the audience were young women, and there is no doubt that this film will further ignite the popularity of Kabuki.

That said, the mysterious allure of women portrayed by men is not limited to handsome actors alone. The star of popular theater, Fumio Umezawa—known as the “Tamasaburō of downtown”—possesses an indescribable charm when he portrays an enchanting woman on stage. We must recognize that creating something into truly captivating is never easy. How deeply one can concentrate on one’s work and how far one can pursue mastery. I still wish to challenge myself with much more.