On Aug. 8th (Sun), the 32nd Summer Olympic Games in Tokyo successfully completed its 17-day schedule, with approximately 11,000 athletes from 205 countries and regions competing in 339 events in 33 sports in temperatures above 35 degrees Celsius in Tokyo, nearby cities, and Sapporo. The marathon was held in Sapporo, Hokkaido to avoid the high temperatures and humidity of Tokyo. The women’s race was moved up an hour to 6:00 a.m. on the morning of Aug. 7th as precautions against the heat, while the men’s race started at 7:00 a.m. on the morning of Aug. 8th as scheduled. However, the temperature in Sapporo recorded 35 degrees Celsius, the same as Tokyo, and 30 of the 106 participants abandoned the race. In Hokkaido, it used to be said that air conditioning was not necessary even in the middle of summer, but now it is a necessity. We need to take global warming seriously!

On Aug. 8th (Sun), the 32nd Summer Olympic Games in Tokyo successfully completed its 17-day schedule, with approximately 11,000 athletes from 205 countries and regions competing in 339 events in 33 sports in temperatures above 35 degrees Celsius in Tokyo, nearby cities, and Sapporo. The marathon was held in Sapporo, Hokkaido to avoid the high temperatures and humidity of Tokyo. The women’s race was moved up an hour to 6:00 a.m. on the morning of Aug. 7th as precautions against the heat, while the men’s race started at 7:00 a.m. on the morning of Aug. 8th as scheduled. However, the temperature in Sapporo recorded 35 degrees Celsius, the same as Tokyo, and 30 of the 106 participants abandoned the race. In Hokkaido, it used to be said that air conditioning was not necessary even in the middle of summer, but now it is a necessity. We need to take global warming seriously!

To prevent an increase in the number of people infected with the new coronavirus, a state of emergency was declared in Tokyo on Jul. 12th, followed by Kanagawa, Chiba, and Saitama prefectures on Aug. 2nd. However, by Aug. 5th, the number of infected people had increased to 5,042 in Tokyo. There were arguments for and against the Olympics being held in the midst of the corona disaster, but there is no other international peace festival that is held once every four years, where well-trained athletes from all over the world gather, respect each other, and compete. Although the games were held without spectators, many people must have applauded the athletes on TV and praised their good performance. Also, seeing the flags of 205 countries and regions at the opening ceremony must have given viewers a chance to reacquaint themselves with the world. On the other hand, we can’t talk about the successful completion of the Olympics without mentioning the dedicated activities of the medical personnel and volunteers. Although 30% of the municipalities withdrew from the host towns and pre-Olympic camps due to infection control measures, it must have been a valuable opportunity of international exchange for more than 600 local residents and children to experience their own country hosting the Games. I am sure that the event helped to inspire children to nurture their dream of spreading their wings to the world.

According to the July employment data released by the U.S. Department of Labor on Aug. 6th, the number of non-farm workers increased by 943,000, exceeding the market forecast of 850,000. The unemployment rate in July was 5.4%, 0.5 points down from the previous month, but the number of people in employment in July was still about 5.7 million below the pre-Corona level. Although people tend to stay away from low-wage jobs with the risk of COVID-18 infection, a gradual recovery in the labor market is expected as wages are rising and the U.S. government’s unemployment benefits for COVID-18 infections is going to end in early September.

Shipping Guide cited a freight rate index released by Drewry Maritime Research (UK) on May 5th. The overall World Container Index (WCI) for the eight major shipping routes to and from the U.S., Europe and Asia rose 0.4% ($41) week-on-week to $9.371.30 per FEU, up for the 16th consecutive week and 370% higher than the same period last year, continuing a record high. The average since the beginning of this year was $6,196 per FEU, $2,164 higher than the previous five-year average of $4,032 per FEU. By route wise, Shanghai–>Rotterdam rose 2% ($279) to $13,628 per FEU. Shanghai–>Los Angeles fell 3% to $10,229 per FEU, and Shanghai–>New York was unchanged at $13,489 per FEU. It is expected that the market will continue to rise this week, but only mildly. The Japan Maritime Daily introduced the outlook of S&P Global Platts, a major U.S. research firm, which said that although the Chinese National Day vacation from October will be a slack season, cargo demand would be very strong this year and freight rates would remain high.

Shipping Guide cited a freight rate index released by Drewry Maritime Research (UK) on May 5th. The overall World Container Index (WCI) for the eight major shipping routes to and from the U.S., Europe and Asia rose 0.4% ($41) week-on-week to $9.371.30 per FEU, up for the 16th consecutive week and 370% higher than the same period last year, continuing a record high. The average since the beginning of this year was $6,196 per FEU, $2,164 higher than the previous five-year average of $4,032 per FEU. By route wise, Shanghai–>Rotterdam rose 2% ($279) to $13,628 per FEU. Shanghai–>Los Angeles fell 3% to $10,229 per FEU, and Shanghai–>New York was unchanged at $13,489 per FEU. It is expected that the market will continue to rise this week, but only mildly. The Japan Maritime Daily introduced the outlook of S&P Global Platts, a major U.S. research firm, which said that although the Chinese National Day vacation from October will be a slack season, cargo demand would be very strong this year and freight rates would remain high.

According to the Daily Cargo, MCS Industries, a U.S. importer, filed a complaint with the Federal Maritime Commission (FMC), claiming that two major container shipping companies (MSC and COSCO) had defaulted on their contracts and intentionally raised spot freight rates by which they suffered a loss to the tune of more than $600,000, demanding the payment of compensation and fulfillment of the transportation contract. Their objection was accepted on Aug. 3rd. Meanwhile, on Jul. 20th, FMC set up a monitoring program against container shipping companies and a dedicated team to deal with the issue, and said it would investigate whether the shipping companies’ imposition of demurrage and detention charges was appropriate.

Shipping companies might be feeling as nonsense, the unreasonable complaints from shippers about high freight rates and monitoring by FMC for demurrage and detention charges. When shipping companies provide containers to shippers as COC, there is nothing they can do until the shippers come to pick up the containers or return the containers they are using. The only way to motivate shippers is to charge them for the containers in use. Under the current situation where container shortage is becoming more and more serious, it is necessary to encourage shippers to pick up and return containers by such charges.

The main reason for the soaring freight rates is the lack of container handling capacity at U.S. ports and the shortage of dockworkers due to the Corona disaster. The problem of backlogged vessels in Los Angeles and Long Beach is the worst ever, with 30 vessels said to be waiting for berth in the first week of Aug. More congestion is expected as we head into the peak import season of September and October. The railroad service on the west coast of the U.S. is making the situation worse. On Jul. 18th, the UP Railroad suspended rail traffic from the west coast of the U.S. to the intermodal freight hub (Global 4) in Chicago for a week due to disruptions.

Despite a 40% year-on-year increase in cargo movement on North American routes from January to June this year, we have to say U.S. ports and railroads have not prepared enough for the strong cargo movement from China and Asia since the Lehman shock, even taking into consideration the Corona disaster. As a result, they have been exposed to problems in their ability to handle the increasing amount of import cargo. On the other hand, is it acceptable that the two U.S. West Coast railroads, Union Pacific (UP) and BNSF are monopolizing the market? Shouldn’t FMC look into their own port and rail infrastructure to restore the current flow of containers being stuck in ports and inland, or to improve the flow of supply chains?

The mainstream of global logistics is the supply chain. If that flow stops, global logistics will be paralyzed and become chaotic. This is what is happening in the world right now. In response to the expansion of logistics, shipping companies have been working to upgrade their container ship scale to ultra-large. Currently, 24,000 TEU vessels are deployed on European routes, with 10,000-15,000 TEU vessels being deployed on the west coast of North America, using the cascade system, to successfully operate container vessels. Aside from European ports, major ports in the U.S. need to improve their infrastructure, including port facilities and rail services, and to continue to invest in facilities so as not to stop global logistics.

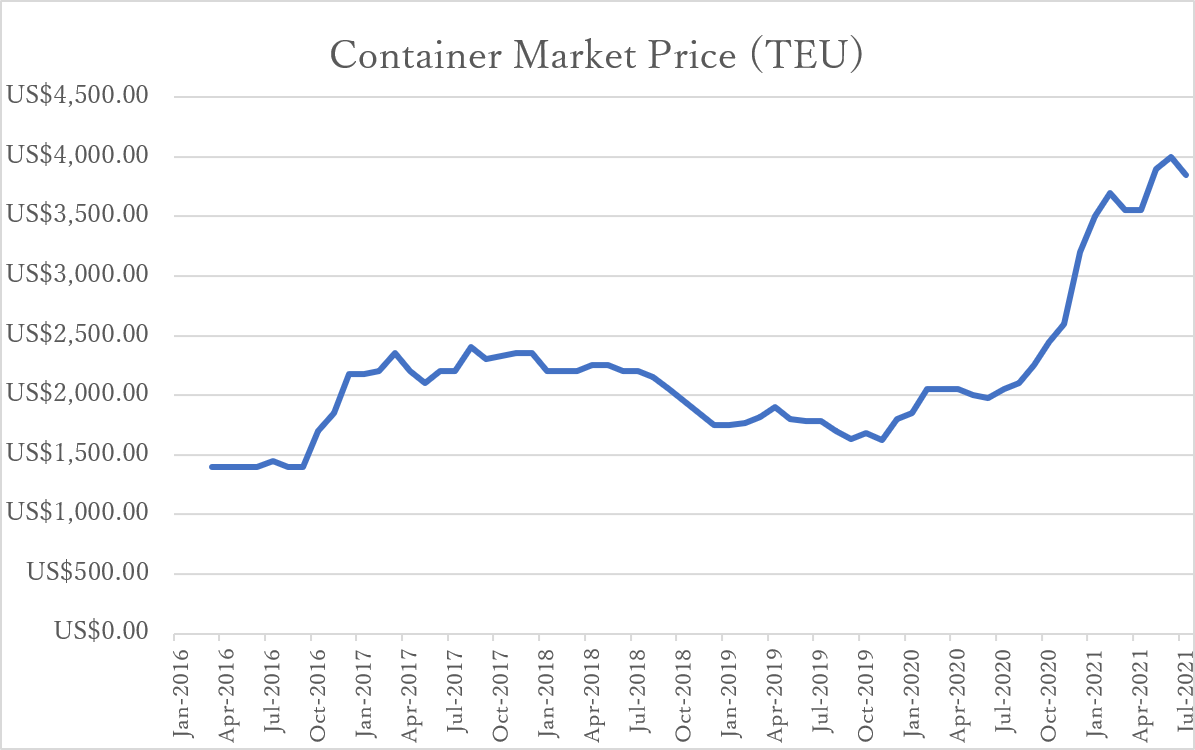

New container price at the end of July was $3,850 per 20f, 3.8% down from previous month. New container production in July was 686,867TEU (Dry: 658,604TEU, Reefer: 28,263TEU). Factory inventory was 439,115 TEU (Dry: 339,995 TEU, Reefer: 99,120 TEU).

This year, container leasing companies are making remarkable investments in containers. The following is a list of the top five container leasing companies by order volume. Triton, in particular, has ordered 784,250 TEUs in the January-July period. It has been a long time since shipping companies have relied on leasing companies that much as they have this year. Most of the leasing companies are operating containers at almost 100% operating rate.

| 2021 | 2021 | |||||||

| Owner | Jan | Feb | Mar | Apr | May | Jun | Jul | Total (TEU) |

| TIL | 83,300 | 65,300 | 112,000 | 146,000 | 97,970 | 159,430 | 120,250 | 784,250 |

| TEX | 82,300 | 42,040 | 86,600 | 51,800 | 55,250 | 69,400 | 64,850 | 452,240 |

| FLORENS | 70,800 | 13,750 | 21,300 | 42,800 | 17,080 | 9,800 | 12,100 | 187,630 |

| CAI | 7,500 | 0 | 15,200 | 6,000 | 48,290 | 44,100 | 47,100 | 168,190 |

| SEACO | 47,540 | 4,400 | 23,200 | 3,100 | 11,500 | 6,000 | 7,500 | 103,240 |

The price of a newly built container is about 2.8 times higher than it was five years ago. There are signs that the price of new container production is about to hit the peak.