“The U.S. economic recovery toward the second half of this year” The back ground and its scenario

The number of nonfarm payrolls in the January employment report released by the U.S. Department of Labor on February 3rd increased by 517,000 from the previous month. The unemployment rate was 3.4%, down 0.1% from the previous month, the lowest level since May, 1969. Average hourly earnings rose 0.3% month-on-month. Meanwhile, the U.S. Federal Reserve Board (FRB) prioritized inflation control on February 8th, suggesting tighter monetary policy.

The number of nonfarm payrolls in the January employment report released by the U.S. Department of Labor on February 3rd increased by 517,000 from the previous month. The unemployment rate was 3.4%, down 0.1% from the previous month, the lowest level since May, 1969. Average hourly earnings rose 0.3% month-on-month. Meanwhile, the U.S. Federal Reserve Board (FRB) prioritized inflation control on February 8th, suggesting tighter monetary policy.

The U.S. economy is said to be in recession, and in response, four of the five major IT companies in the U.S., Microsoft, Alphabet, Meta, and Amazon, excluding Apple, are cutting 51,000 employees in total. The five companies have approximately 2.2 million employees. 80% of them, or 1.76 million people, were employed in the past three years. The total market value of the five companies was $9.7 trillion (about JPY1,250 trillion) at the end of 2021. One year later, however, that value had been reduced to $5.82 trillion, nearly by 40%. As a result, these companies are cutting jobs on a large scale in response to the demanding shareholders. It seems they can’t escape from the U.S.-style tendency to “follow suit”. Of course, I believe that this is partly a countermeasure against the concern that company growth might become slug because the countries around the world are wary of the market dominance by the five IT companies. In addition, Dell Technology plans to cut 6,600 jobs, or 5% of its 133,000 employees; Zoom announced that it will cut 1,290 jobs, or 15% of its 8,600 employees; U.S. financial giant Goldman Sachs has decided to cut 3,200 jobs, or 6% of its employees; and on February 8th, Disney announced that it will cut 7,000 jobs, or 3% of its 220,000 employees. The number of job cuts by U.S. companies in January was 2.4 times that of the previous month, the highest level since the Lehman Shock.

The U.S. unemployment rate has continued to decline from 10.1% in October 2009, and the current unemployment rate of 3.4% is a symbol of the strong U.S. economy. The U.S. economy is expected to gradually recover toward the second half of this year. This is because the National Retail Federation (NRF) envisions the following scenario; That is to say, retailers misjudged 2022 demand due to the COVID-19 disaster and accelerated import, resulting in excess inventories, and the retail import fell sharply from the second half (July-December) of 2022, but now it is being adjusted and is expected to return to proper inventory level by the end of this year, and U.S. economy will be driven by the logistics, restaurants, lodging, and entertainment service industries, and strong consumer spending, which accounts for 70% of GNP, will bring economic recovery toward the end of the year.

Expectations and Concerns about China’s Economic Recovery

With the lifting of the zero-Covid policy, economic activity in China, which has switched to a policy of acquiring mass immunity, appears to be getting normal. This January was the first Chinese New Year in four years without travel restrictions. The number of travelers has returned to 90% of the pre-COVID 2019. However, the growth rate of the Consumer Price Index (CPI) is increasing. This is due to a supply shortage caused by the reduction of stores and workers in service industries after the three-year-long restriction. Increased eating out and entertainment consumption is another cause of higher prices. In January, consumer prices in China rose 2.1%. The impact on consumer spending, which accounts for 40% of gross domestic product (GDP), should be enormous. I hope that China will get back to normal as soon as possible.

With the lifting of the zero-Covid policy, economic activity in China, which has switched to a policy of acquiring mass immunity, appears to be getting normal. This January was the first Chinese New Year in four years without travel restrictions. The number of travelers has returned to 90% of the pre-COVID 2019. However, the growth rate of the Consumer Price Index (CPI) is increasing. This is due to a supply shortage caused by the reduction of stores and workers in service industries after the three-year-long restriction. Increased eating out and entertainment consumption is another cause of higher prices. In January, consumer prices in China rose 2.1%. The impact on consumer spending, which accounts for 40% of gross domestic product (GDP), should be enormous. I hope that China will get back to normal as soon as possible.

The IMF revised the global growth rate to 2.9% in 2023, down from 3.4% in 2022, and lowered the world trade volume from 5.4% to 2.4% as well. The IMF expects 1 point increase in China’s growth rate to boost the overall global growth rate by 0.3 point. The IMF also speculates that the economic slowdown in Southeast Asia will depend on developments in the Chinese economy. The Chinese government lifted the ban on group travel overseas on February 6th. The impact of tourists from China should not be overlooked. The ripple effect of China’s economic recovery is expected to reach Southeast Asia in the second half of 2023. Meanwhile, the U.S. and Australia have eliminated surveillance camera products made in China from their national defense facilities. China has flown reconnaissance balloons to more than 40 countries, and the world’s developed nations are wary of China’s hegemonism. This will inevitably affect future supply chain flows from China.

Prolonged Russian invasion of Ukraine and severe earthquakes in Turkey and Syria

One year has passed this February since Russia’s invasion of Ukraine. The war is becoming more and more intense. Russia is undermining its own credibility, reducing its wealth, and plunging not only Ukraine but also Europe into chaos. On February 6th, two earthquakes of magnitudes 7.8 and 7.5 struck Turkey, near Syria, causing devastating damage with over 40,000 deaths as of February 14th. Natural disasters are inevitable, but I sincerely wish that man-made disasters will not occur.

Japan needs to raise wages to increase productivity.

Investment in carbon neutrality is a major challenge for all industries worldwide. In 2022, global decarbonization-related investments exceeded $1 trillion (about JPY129 trillion). The United States will have more than 50% of new vehicles sold by 2030 to be EVs and fuel cell vehicles (FCVs). Europe will ban gasoline and diesel vehicles, including HVs, by 2035. Japan has also set a goal to electrify all new cars by 2035. If the retained earnings of JPY500 trillion held by corporations are put into investments to revitalize the Japanese economy, we can easily recover the lost 30 years since the bubble economy in 1990. I would like that investment to be made firstly on workers. If the wages of Japanese workers rise, productivity will surely increase.

According to the National Tax Agency’s “Survey of Private Sector Salaries,” the average salary was JPY4,252,000 in 1990, and JPY4,322,000 in in 2017, an average salary increase of JPY70,000 in 27 years. How do you see this reality? With dreams and hopes gone, the reality will be that we cut back on consumption and save what little we have in order to fund our retirement. An international wage comparison chart prepared by the National Confederation of Trade Unions (Zenroren) based on 2016 OECD data shows that Japan’s real wages have fallen by more than 10% over the 19 years from 1997 to 2016, even though real wages have risen in other countries. The wage gap in 2022 after the COVID-19 disaster is expected to be much wider.

The facts prove that Governor Kuroda’s theory that negative interest rate policy will raise salaries as companies make more money is wrong. Therefore, we hope that Mr. Ueda, who will be appointed as the new BOJ governor in April, will at least strengthen the yen and control import prices which has brought one-third of the increase in prices.

The facts prove that Governor Kuroda’s theory that negative interest rate policy will raise salaries as companies make more money is wrong. Therefore, we hope that Mr. Ueda, who will be appointed as the new BOJ governor in April, will at least strengthen the yen and control import prices which has brought one-third of the increase in prices.

On January 11th, Fast Retailing, operating the casual clothing store UNIQLO, announced that it will raise annual salaries by several percent to 40% starting in March for its 8,400 employees in Japan who work at its headquarter. The greatest respect to President Tadashi Yanai. I would like to sincerely ask incumbent managers to give their precious employees dreams and hopes by raising their salaries to the maximum level possible out of the profits. I am sure that their productivity will definitely increase and sales will exceed your expectations. Although our company is small in size, we reflect profits in wages. As soon as possible, I want to pay our employees as much as that of firms listed on Prime market, and I want them to be happy doing their jobs.

Falling Container Freight Rates and ILWU/PMA Labor-Management Negotiations

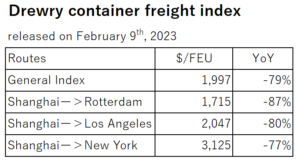

Drewry, a UK-based maritime consultancy, released the following freight rate index on February 9th. The index is expected to remain slightly lower for the next few weeks.

In early February, labor-management negotiations at U.S. West Coast ports, which will determine future ocean freight rates and supply chains, resumed for the first time in four months. Currently, uncertainty over the ILWU/PMA negotiations has caused some U.S. imports to shift from West Coast ports to East Coast ports, which has caused to the sluggish handling volumes at U.S. West Coast ports. It is necessary to continue to monitor the progress of the negotiations.

New container price for January 2023

The newbuild container price in January 2023 was $2,100 per 20f, $100 or 5% increase over the previous month. Factory inventories of newbuild containers were 966,606 TEU (Dry: 902,874 TEU, Reefer: 63,732 TEU), down 75,768 TEU from January. January shipments Total 129,238 TEU (Dry: 116,814 TEU, Reefer: 12,424 TEU) were shipped out in January.

Launch of a representative office in Fukuoka

We EFI launched a representative office in Fukuoka in February. We asked Mr. Mitsunori Takemoto, who just retired from Geneq, to join us because of his long experience and trustworthy personality. We are confident that this will satisfy our clients, as our existing relationship with them will now be converted from a point-to-point to a face-to-face relationship.

Attended Kalmar’s Dealer Conference in Singapore

For last one week, I went on a business trip overseas, for the first time in three years, to Singapore with two of my employees to attend a Dealer conference hosted by Kalmar. It took us more than an hour than planned to enter the country, as we had to go through immigration procedures on our unfamiliar smartphones. I met with a total of more than 60 people, including Dealers from Vietnam, Indonesia, Malaysia, the Philippines, Colombo, Thailand, China, and Korea, as well as executives from Kalmar’s Swedish headquarters, and Kalmar representatives in Singapore, and returned home very inspired. I was surprised at the variety of Kalmar’s Reach Stacker products. I wondered if it is profitable to manufacture so many kinds of products. However, the Swedish product manager was very happy to tell us about them, and we became more and more confident in the quality of Kalmar’s Reach Stacker and Terminal Trucker products. We heard that Kalmar’s Reach Stacker is widely used in South Asia, but that they are having a hard time differentiating it from cheaper products made in China, and we were convinced that the key to finally closing the price gap is proper parts supply and aftercare. On the other hand, I was impressed by the high ability and enthusiasm of the young participants from Asia, and was convinced that the future belongs to Asia.

(Translated by Ms. Chizuru Oowada)