First Business Trip to Europe in Four Years: Intermodal Europe 2023

On Sunday, October 8, I departed from Narita at 10:25 a.m. on flight KLM 864 to attend Intermodal Europe in Amsterdam. This is the first trip to Europe in four years since November 2019, after the COVID-19 pandemic canceled the event in 2020 and 2021, and although it was held in 2022, participation was postponed until the COVID-19 epidemic subsided. A total of seven participants, three including myself, attended the COA reception on the evening of Monday, October 9, and the other four entered Amsterdam on October 9.

Normally, we would have booked a hotel in the city, but this time, due to the low yen, hotels in the city were quite expensive, and since we were a large group of 7 people, we thought it would be more convenient to travel by car, so we stayed at the Holiday Inn in the suburbs. We rented a car at Schiphol Airport and were able to drive to the airport, hotel, venue, and restaurants, so we were able to see Amsterdam and the Netherlands in a different perspective. The two people who had been stationed in Europe on business, one of them in Rotterdam, and were quite familiar with the Netherlands, so I felt very safe with him driving us around.

The outbound flight was not allowed to fly over Siberia, so we entered Amsterdam via Alaska in the Arctic Circle, which took 14 hours, about 2 hours more than before. The return flight was southbound, passing over Poland, Kazakhstan, and China, which meant that we had circled the northern hemisphere. Due to the depreciation of the yen and inflation, the prices of goods seemed to have increased by more than 50% compared to before. I hope that Bank of Japan Governor Ueda will quickly correct the weak yen.

To my surprise, when I arrived at the hotel on 8th, the BBC reported that Hamas, the Islamic organization that effectively controls the Palestinian territory of Gaza, had attacked Israel and the Israeli army had counterattacked, causing many casualties on both sides in addition to civilians. With Russia’s invasion of Ukraine and the addition of the Middle East, the world is becoming increasingly chaotic. We can only hope that war can somehow be avoided and the problems can be resolved peacefully.

U.S. Economy: Concerns about prolonged monetary tightening, imports expected to fall from the previous year

According to the September employment report released by the U.S. Department of Labor on October 6, the number of nonfarm payrolls increased by 330,000 from the previous month and the unemployment rate was 3.8%, the same as in August. Average hourly earnings rose 0.2% from the previous month, representing a year-on-year increase of 4.2%. Financial markets are looking for a prolonged period of monetary tightening by the Fed against the possibility of inflation remaining high due to nearly double the expected growth in the number of workers and the wage demands of the major auto unions’ massive strike. Right now, the U.S. is leading the global economy. I would say to Federal Reserve Chairman Jerome Powell that there is no need for further rate hikes that would suppress that traction.

According to the latest report compiled by the National Retail Federation (NRF), this August’s results were actually only 1.96 million TEUs, a 2.3% increase from the previous month, although import forecasts had been looking for 2.00 million TEUs since last August. Therefore, the six-month forecast was also revised as follows. 1.94 million TEU in September, down 4.3% (y/y); 1.94 million TEU in October, down 3.1%; 1.91 million TEU in November, up 7.5%; 1.88 million TEU in December, up 8.9%; 1.88 million TEU in January, up 4.2%; and 1.74 million TEU in February, up 12.7% in 2024. Full-year 2023 retail container imports are expected to decline from 22.3 million TEUs to 22.1 million TEUs.

WTO Downgrades Global Trade Forecast for 2023

Container Trades Statistics (CTS UK) reports that global containerized cargo volumes for August of this year totaled 15,315,523 TEUs, up 3.7% year-on-year.

Container Trades Statistics (CTS UK) reports that global containerized cargo volumes for August of this year totaled 15,315,523 TEUs, up 3.7% year-on-year.

On October 5, the World Trade Organization (WTO) revised downward its forecast for world trade volume (trade in goods) in 2023 to a 0.8% y/y increase from its previous April forecast (1.7% y/y increase).

World trade volume in 2024 is expected to grow 3.3%, the same as the previous forecast, and the world real GDP growth rate is set at 2.6% in 2023 and 2.4% in 2024. In addition, the report points to signs of change in the supply chain. Asia’s share of U.S. trade in parts and accessories, a major part of intermediate goods in global trade, a measure of global supply chain activity, has dropped to 38% from 43% in the first half of 2022.

EU Antitrust Rules Require Re-Alignment

The next was also somewhat surprising news. On October 10, the European Commission announced that it will not extend the EU’s antitrust exemption (CBER) for consortia of container carriers within the European Union. This means that the CBER will expire next year, on April 25, 2024.

The next was also somewhat surprising news. On October 10, the European Commission announced that it will not extend the EU’s antitrust exemption (CBER) for consortia of container carriers within the European Union. This means that the CBER will expire next year, on April 25, 2024.

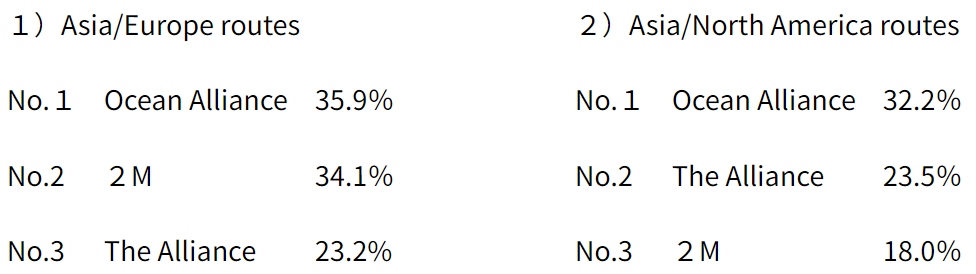

According to the alliance share as of August 2022, the following figures are available. (Reference to “Global Container Transport and Service Conditions 2022,” published by NYK Research Group)

The EU CBER has a market share of 30% as a guideline, so if we go by this, Ocean Alliance and 2M will become an issue on the Asia/Europe route. The U.S. has a similar trend in antitrust law, so the Ocean Alliance is likely to become an issue on the Asia/North America route in the future. 2M has already decided to dissolve in 2025. The consortia will end in 2027 for Ocean Alliance and 2030 for The Alliance.

After April 25, 2024, various restrictions may be placed on the consortia, and it is possible that the consortia members other than 2M will review their routes in which they hold more than 30% share of the market, by the re-alignment of the consortia, or by becoming a single operator.

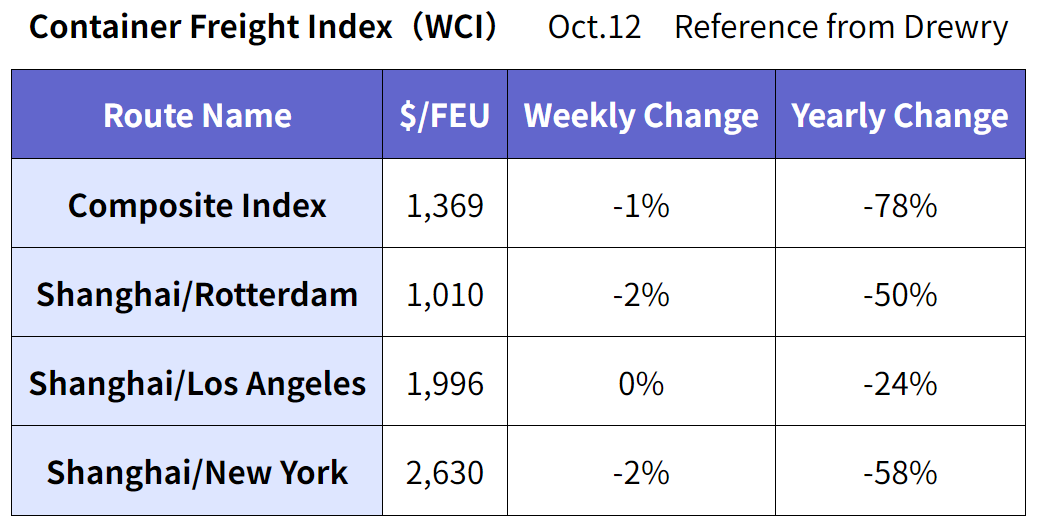

Latest Container Freight Rate Indicators

Container Leasing Companies Make Efforts to Ship Used Containers to China, Asia by O/W, and Return to Japan

Major container leasing companies appear to be maintaining high occupancy rates of 95-98% at present. For 5 to 8 year long term lease contracts, they seem to be offering favorable terms and asking for re-extension. On the other hand, older containers, those that are more than 12-15 years old, are either shipped O/W (One Way = Rent to forwarder, etc., and have it transported by full.) to China and other Asian countries where they can be sold at the highest possible price, or are sent back empty. On the other hand, Japan is a country where the demand of used containers is very high, so not only leasing companies but also shipping companies are making efforts to return used containers to Japan. The quality of Japanese used cars is highly regarded, and nearly 100,000 used cars and parts are exported from Japan every month. A few percent of these vehicles are exported mainly in used 40-foot Hi-cube containers.

New Container Information for September 2023

Newly-built containers in September was 230,992 TEU (Dry: 219,089 TEU, Reefer: 11,903 TEU). September is the busiest month for cargo movements throughout the year. The number of units manufactured in September increased by 27,467 TEU, or 13% from the previous month (Dry: up 32,997 TEU, or 18% from the previous month; Reefer: down 32% from the previous month), with Dry production increasing and Reefer production decreasing. The number of newly-built containers at factory totaled 869,072 TEU (Dry: 812,454 TEU, Reefer: 56,618 TEU). This is a decrease of 38,748 TEUs from the previous month (Dry: 4%, down 30,814; Reefer: 12%, down 7,934 TEUs), with 269,740 TEUs (Dry: 249,903 TEUs, Reefer: 19,837 TEUs) of newbuilt containers being shipped from the factory.

EFI staff gained valuable experience and confidence in Europe

Participating in Intermodal Europe for the first time in four years brought a lot of strength and confidence to EFI. I also strongly felt the high expectations to EFI by many of the people I met. It was also a trip that reaffirmed to me that EFI’s staff is building up their strength. One might accuse such a small company, which will be in its 15th year next year, of not knowing your position to send seven staff members to Europe at once, but I believe that it is not expensive at all to give a growing and talented staff a valuable experience.

Participating in Intermodal Europe for the first time in four years brought a lot of strength and confidence to EFI. I also strongly felt the high expectations to EFI by many of the people I met. It was also a trip that reaffirmed to me that EFI’s staff is building up their strength. One might accuse such a small company, which will be in its 15th year next year, of not knowing your position to send seven staff members to Europe at once, but I believe that it is not expensive at all to give a growing and talented staff a valuable experience.

On the other hand, one of the most relieving things about coming back to Japan is being able to relax in the bathtub at home. Soaking in hot water up to my neck slowly relieves my fatigue. And the “Washlet”, a hot-water washing toilet seat, in the bathroom is also very comfortable. Once you learn to enjoy this feeling of comfort, you will never want to give it up. I hope that Japanese bath and toilet seat manufacturers will market Japanese-style baths and toilet seats in Europe for the sake of human happiness and health. I would also like to emphasize that there is still a large market for them all over the world.

(Translated by Mr. Masaki Nakatsu)