Urgent correction of the high U.S. interest rate policy!

According to the October employment report released by the U.S. Department of Labor on October 3, the number of nonfarm payrolls increased by 150,000 from September. The unemployment rate was 3.9%, up 0.1% from 3.8% in August and September. Average hourly earnings are up 0.2% from the previous month. At the same time, however, the Fed’s high interest rates and inflation control policy, which began in March 2022, is having a significant impact on the real economy. The interest rate on a 30-year fixed mortgage has risen from 3% two years ago to 8% at present. Four-year loans for new car purchases have risen from 6% to 8.3% in the past year. Credit card company American Express reported $1.233 billion in bad debt expense for the July-September period, a 60% increase from the same period last year. Consumer spending activity, which accounts for 70% of the U.S. gross domestic product (GDP), is the key to a soft landing for the U.S. economy. I hope that the Federal Reserve Board (FRB) Chairman Jerome Powell will give a little more thought to the American people.

According to the October employment report released by the U.S. Department of Labor on October 3, the number of nonfarm payrolls increased by 150,000 from September. The unemployment rate was 3.9%, up 0.1% from 3.8% in August and September. Average hourly earnings are up 0.2% from the previous month. At the same time, however, the Fed’s high interest rates and inflation control policy, which began in March 2022, is having a significant impact on the real economy. The interest rate on a 30-year fixed mortgage has risen from 3% two years ago to 8% at present. Four-year loans for new car purchases have risen from 6% to 8.3% in the past year. Credit card company American Express reported $1.233 billion in bad debt expense for the July-September period, a 60% increase from the same period last year. Consumer spending activity, which accounts for 70% of the U.S. gross domestic product (GDP), is the key to a soft landing for the U.S. economy. I hope that the Federal Reserve Board (FRB) Chairman Jerome Powell will give a little more thought to the American people.

2. Eurozone is worried about the economy, while Japan’s retained earnings have increased for11 straight years. Weaker yen?

Real gross domestic product (GDP) in the euro area, which comprises the 20 countries of the European Union (EU), declined 0.1% in the July-September period from the previous quarter. On an annualized basis, growth fell to -0.4%, the first negative growth in three quarters. It is true that sharp interest rate hikes to curb inflation have become a burden. On top of that, Russia’s invasion of Ukraine and the military clash between Israel and the Islamic organization Hamas have rekindled high resource prices, which has increased economic uncertainty.

The net income for the April-September period of 2023 of 393 companies, or just under 40% of the companies listed on the TSE prime listings that close their books in March, is the highest earnings in the industry, up 30% from the same period of the previous year. Toyota Motor Corporation’s net income increased 2.2 times year-on-year to 2.5894 trillion yen, thanks to a 260 billion yen depreciation of the yen.

In October, the International Monetary Fund (IMF) released its forecast of nominal gross domestic product (GDP) for each country, and Japan was overtaken by Germany and dropped to fourth place. It is currency magic. On the other hand, corporate profit surpluses (retained earnings) in 2022 totaled 554.7777 trillion yen, up 7.4% from the previous year, the 11th consecutive year of record profits.

Yen Carry Trade Expanding Around the Globe; BOJ’s Self-important Policies to be Amended!

The yen hit $1.00=Yen151 on October 31. The yen has fallen not only against the dollar but also against the euro since the beginning of the year, reaching 161 yen per euro on 7th, the weakest since August 2008. The yen also weakened against the Australian dollar to 97 yen per Australian dollar, the weakest in four and a half months. Against the Singapore dollar, the yen weakened for the first time since 1985, falling to 111 yen per Singapore dollar. The yen has depreciated all over the world against currencies of various countries. This is due to the expansion of “Yen carry trade”, in which the yen is borrowed from low interest rate yen and invested in high interest rate currencies. Kazuo Ueda, Governor of the Bank of Japan! Do you still want to maintain negative interest rates? I would like him to stop making more sacrifices for the people of Japan with their self-indulgent policies.

Have container freight rates bottomed out?

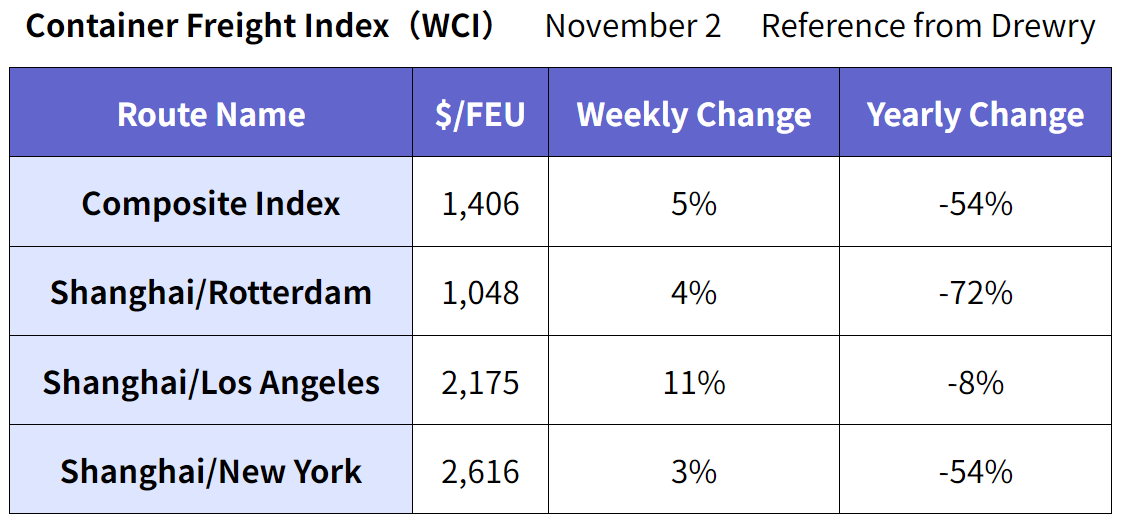

Drewry’s WCI, a containerized freight rate index released on November 2, showed a 5% week-on-week increase in the overall index to $1406/FEU, the first week-on-week increase in 11 weeks. Shanghai-bound to Rotterdam rose 4%, the first increase in two weeks. Shanghai-bound to Los Angeles rose sharply, up 11%. Shanghai to New York was also steadily up. We expect freight rates on East-West routes to remain near current levels in the coming weeks.

Panama Canal Drought Impacts, Decrease in Number of Vessels Stayed, but Concern about Prolonged Time

The Panama Canal is in the midst of the worst drought in the past 100 years, which is exacerbating the drought and reducing the number of vessels that can pass through the canal. The cause of the water shortage is reported by the El Niño phenomenon, which has increased sea water temperatures and delayed the timing of rainfall. The Panama Canal is an 80-kilometer-long man-made canal that connects the Pacific and Atlantic oceans.

The Panama Canal is in the midst of the worst drought in the past 100 years, which is exacerbating the drought and reducing the number of vessels that can pass through the canal. The cause of the water shortage is reported by the El Niño phenomenon, which has increased sea water temperatures and delayed the timing of rainfall. The Panama Canal is an 80-kilometer-long man-made canal that connects the Pacific and Atlantic oceans.

In 2016, an expansion to accommodate larger cargo ships was completed, allowing passage for Neo-Panamax ships in addition to the Panamax ships that can pass through.

The Panama Canal has announced a policy of narrowing the number of ships passing through per day from an average of 36 to 31 starting in November.

In August, there were 200 vessels in arrears, which has now been reduced to 108. However, the waiting time has been as long as two weeks, and the number of backlogged vessels may increase again and become longer in the future. Meanwhile, there is also a westbound route via the Suez Canal, but the Suez Canal Authority will increase vessel tolls by 5-15% starting January 15, 2024. The increase will not apply to container ships from northwestern Europe directly to the Far East.

Maersk’s Expansion of Ship Asset Ratio Backfires

On November 3, AP Moller Maersk of Denmark announced its financial results for the July-September period of 2023. Operating income was $1.9 billion, down sharply from $10.9 billion in the same period last year. Net income was $554 million, down 94% from the same period last year. Net sales fell 47% to $12.1 billion. The stock price temporarily hit a three-year low of more than 12%. As a result, the company announced that it would cut 10,000 employees, or about 10% of its total workforce, by the end of 2023. This workforce reduction is expected to result in cost savings of $600 million.

Despite the asset mitigation trend during Covid disaster, Maersk has been expanding the ratio of its own container vessels in anticipation of post-COVID-19 pandemic demand. The ratio of ship assets to total assets has reached approximately 40%. The company is currently suffering from the triple burden of excess capacity, rising costs, and falling freight rates for its heavy assets. Maersk expects this condition of severe revenue decline to continue for the next two to three years and has decided to review its share purchase and lower its capital expenditures in 2024. This is one of the world’s largest container shipping companies, responsible for about 17% of the world’s container transportation. We can see the harsh reality in its words and actions.

Change from ONE policy of No Asset?

Ocean Network Express, a container shipping company jointly owned by three Japanese shipping lines (NYK, MOL, and K Line), announced on October 31 its financial results for the fiscal year 2023 (April 2023 to March 2024), with after-tax profit expected to decline 94% from the previous year to $851 million. The company expects sales to decrease 51% from the previous year to $14,471 million, EBITDA (earnings before interest, taxes, depreciation, and amortization) to decrease 89% to a surplus of $1,855 million, and EBIT (earnings before interest and taxes) to decrease 98% to a surplus of $252 million. A dividend of $210 million will be paid out to the three companies as of November 15. Also, $1.987 billion was paid in June of this year.

ONE was established in 2017 and at the end of 2021 will have 1.54 million TEUs in operation, ranking 6th in the world and accounting for 6% of the market share.

It has announced an investment projection of more than $200 million (¥2.4 trillion) by 2030.

The scale of operations in 2030 is projected to be 2.4 million TEUs, an increase of nearly 60% from the current scale. On June 2, “ONE INNOVATION,” the first of a series of six 24,136 TEU container vessels, went into service. The vessel is a long-term charter vessel with a 15-year term. ONE’s first newly built and owned vessel is a 10-ship, 13,700 TEU container vessels ordered on March 15. The vessels will be in service from 2025-26.

Stonepeak Acquires Textainer Proof of the Container Leasing Industry’s Prospects

On October 22, U.S. infrastructure investment firm Stonepeak announced that it has acquired Textainer, a Bermuda-based leasing company with the world’s No. 2 operational scale. The purchase price was $50 per share of common stock, which added up to a premium of approximately 46% over the closing price on October 20. The enterprise value will be approximately $7.4 billion.

On October 22, U.S. infrastructure investment firm Stonepeak announced that it has acquired Textainer, a Bermuda-based leasing company with the world’s No. 2 operational scale. The purchase price was $50 per share of common stock, which added up to a premium of approximately 46% over the closing price on October 20. The enterprise value will be approximately $7.4 billion.

Textainer, which began operations in 1979, has been listed on the NYSE since 2007, and owns and manages more than 4 million TEUs of containers, will complete the acquisition in the first quarter of 2024, subject to shareholder approval, and go private.

This follows Brookfield Infrastructure Corp’s April acquisition of Triton, the industry’s No. 1 company that owns and manages more than 7 million TEUs. The acquisition will be completed in the fourth quarter for $85 per share (including $68.50 in cash and $16.50 in BIPC stock). Triton’s enterprise value was set at $13.3 billion (about 1.76 trillion yen).

Triton was founded in Bermuda in 1980, listed on the New York Stock Exchange in 2017 after merged with a major leasing company, TAL, and tried to expand its operations.

This has given significant leverage to container leasing industries. This is a proof that container leasing companies have been recognized by institutional investors as a potential investment target, and backed by large financial resources, I think we can say that this industry has a promising future as an industry that will continue to grow and develop.

CIMC container sales volume falls

CIMC, the world’s largest container manufacturer, reported a 34% year-on-year decline in container sales volume from July to September this year to 242,000 TEUs, including a 37% decline in dry containers to 213,000 TEUs and a 12% drop in reefer containers sales to 29,000 TEUs, the lowest level since 2009. Net sales fell 6.6% to 34.5 billion yuan (US$4.7 billion), operating income fell 61.3% to 898.2 million yuan, and net income fell 52.0% to 461 million yuan. Container sales volume for the January-September period totaled 557,000 TEUs, down 50%; Dry containers fell 53% to 477,000 TEU, and Reefer containers recorded a 20% decline to 80,000 TEUs.

New Container Information in October 2023

The October production price is $2,000 per 20f. This is $100 less than $2,100 per 20f in January of this year. The price reached a high of $2,400 per 20f in March, remained the same through May, declined to $2,200 per 20f in June and July, hit $2,100 per 20f in August, and then dropped to $2,000 per 20f in September.

Newly-built containers in October totaled 184,119 TEU (Dry: 172,077 TEU, Reefer: 12,042 TEU). Factory inventories were 835,911 TEU (Dry: 785,115 TEU, Reefer: 50,796 TEU).

October deliveries totaled 217,200 TEU (Dry: 199,416 TEU, Reefer; 17,864 TEU).

Compared to the previous month, overall production was down 20%, Dry was down 21%, and Reefer was up 1%. Meanwhile, newly-built container factory backlogs were 3.8% down overall, down 3.4% in Dry, and down 10% in Reefer. The number of containers manufactured decreased and the number shipped from the factories increased, resulting in a decrease in factory inventories.

Drewry’s China and Asia Economic Outlook

According to shipping consultant Drewry (UK), container exports from China’s top eight ports in September fell 2% from the previous month to 6.5 million TEUs.

According to shipping consultant Drewry (UK), container exports from China’s top eight ports in September fell 2% from the previous month to 6.5 million TEUs.

On a year-to-year basis, September’s increase was 20% due to the low level of the previous year, but the year-to-date total for January-September was up only slightly to 47.3 million TEU, a 1.3% increase over the same period last year. Container handling volume (including exports, imports, transshipments, and empties) forecast for Greater China next year is for a 1% y/y increase, with growth expected to be slower than in Southeast Asia and South Asia. The report points out that China is no longer benefiting overall Asian growth and will decline relatively compared to Asian region except China, as production is relocating out of China, container exports out of China are not yet negative, but growth has slowed, due to cost pressures, geopolitical tensions, and trade disputes.

The world is becoming increasingly chaotic, but we do what we need to do and we would like to do business by looking five to ten years into the future.

(Translated by Mr. Masaki Nakatsu)