Headline

1. Business trip to Singapore, impact of weak yen and unexpected cold weather!

2. The Fed’s High-Interest Rate Strategy, When to Cut Rates?

3. Will Wage Increases by Strikes Lead to a Virtuous Circle in the European Economy?

4. Sluggishness of the Chinese economy as seen from pork demand!

5. Suggestions for the BOJ’s low interest rate strategy, “A strong yen is the dignity of Japan!“

6. Effect of the Choice of Cape of Good Hope Route on Ocean Freight Rates?

7. Possibility of the Realignment of Alliances due to Hapag Lloyd’s Withdrawal from The Alliance

8. New Container Information in January 2024

9. Impact of Prolonged Diversion via the Cape of Good Hope on Vessels Deployment & Capacity and Ocean Freight Rates

10.Launch of EFI Nagoya Representative Office

As the weather forecast predicted, rain turned to heavy snow in the afternoon of Monday, February 5, and by the time I left my office after 6:00 p.m., a lot of snow covered streets. The snowfall in Yokohama was forecasted to be 4 cm, but, on the way home, my legs were caught by a deep snowfall that I thought it might be at least 10 cm. I walked up an uphill slope keeping my feet firm, and then walked a downhill trying to keep my balance. All expressways of Tomei, Chuo, Kan-Etsu and the Metropolitan expressways in central Tokyo were closed, so the main roads were heavily jammed with quite a few cars. A large truck was rattling on the open roads, making chain noise, spattering snow, moving and stopping, and driving through the traffic jams as if it owned the road. A driver who was not familiar to drive in the snow was gripping the steering wheel with a confused look on his face. One step into an alley, on a steep uphill slope or on a steep downhill road, several cars were stranded and left after losing control. This is a scene I seldom see once every few years.

1. Business trip to Singapore, impact of weak yen and unexpected cold weather!

I went on a business trip to Singapore in the fourth week of January, the first time in a year. Last year, I was confused by the immigration checks, but this year, all procedures were completed by IT devices. I held up my smartphone with an app input the necessary information, and then my passport and fingerprints were checked for the entry. On the other hand, owing to the depreciation of the yen, everything is still going up. In my sense, the exchange rate of Singapore dollar and yen is S$1.00=Yen 60-80; now it is S$1.00=Yen 110, so the price has gone up by 40-80%.

I went on a business trip to Singapore in the fourth week of January, the first time in a year. Last year, I was confused by the immigration checks, but this year, all procedures were completed by IT devices. I held up my smartphone with an app input the necessary information, and then my passport and fingerprints were checked for the entry. On the other hand, owing to the depreciation of the yen, everything is still going up. In my sense, the exchange rate of Singapore dollar and yen is S$1.00=Yen 60-80; now it is S$1.00=Yen 110, so the price has gone up by 40-80%.

Besides, Singapore was very cold. Hotels, restaurants, and offices were all air-conditioned considerably. I was impressed to see the Japanese expatriates with whom I interviewed kept the cold out by wearing fleece jackets with the company logo on them. If Singapore raised its air-conditioning temperature to the same level of Japan, it would greatly contribute to economic benefits and carbon- neutral.

2. The Fed’s High-Interest Rate Strategy, When to Cut Rates?

According to the U.S. employment statistics for January released by the Labor Department on January 2, the number of nonfarm payrolls increased by 353,000 from the previous month, the unemployment rate fell below 4% for the second consecutive year to 3.7%, and average hourly earnings rose 4.5% from the same month last year. The labor market remains positive. On the other hand, the number of job leavers, 3.4 million, has returned to pre-COVID-19 levels, so the employment circumstance is already becoming levelled off. Workers are bifurcated, with most seeming to be buying cheaper items as their COVID-19 aid runs out and they exhaust their credit limits, then get by installment payments to cut back on spending. A strong labor market is certainly protecting the U.S. economy from recession.

With this strong performance, the market expects the Federal Reserve Board (FRB) to cut interest rates; however, Chairman Powell has ruled out the possibility of a March rate cut, the first one this year. Shouldn’t a gradual rate cut begin early, when businesses are willing to invest and consumer spending is strong, to strengthen the footing of the U.S. economy? One of the major pillars of consumer spending (which accounts for 70% of GDP), the backbone of the U.S. economy, is the purchase of new homes. It is necessary to create an environment that increases their willingness to buy and encourages new home builders to invest aggressively.

The U.S. Manufacturing Business Confidence Index released by the U.S. Supply Management Association on February 1 has been below 50, the dividing line between boom and bust, for 15 consecutive months. This coincides with the period when the Fed raised interest rates. In addition, an immediate correction of interest rate hikes should be made to prevent the financial instability of U.S. regional banks caused by the plunge in New York Community Bancorp’s (NYCB) stock price on February 2 from causing a repeat of the series of regional bank failures that began with Silicon Valley Bank (SVB) in March 2023. A policy of maintaining interest rates any higher is never going to be positive for the U.S. economy.

3. Will Wage Increases by Strikes Lead to a Virtuous Circle in the European Economy?

The European Union reported on February 1 that the preliminary Eurozone consumer price index rose to 2.8% in January, but the rate of growth slowed for the first time in two months. EU’s tightening of monetary policy to combat inflation appears to be paying off. Year-on-year real wage growth for the July-September 2023 period is 1.6% in the UK, 0.6% in Germany, and 0.7% in the US, incidentally. Workers in Europe and the U.S. are raising real wages through strikes. This has created a virtuous cycle of higher prices, higher wages, and higher purchasing power in a positive sense, and I believe it will not be long before the economy gets back on track for growth.

4. Sluggishness of the Chinese economy as seen from pork demand!

The Purchasing Managers’ Index (PMI) for January, released by China’s National Bureau of Statistics on January 31, was 49.2, below 50 since April 2023 (excluding September 2023). Following the bankruptcy of Evergrande Group, the business crisis of Country Garden has surfaced, and the real estate bubble, which accounts for 30% of China’s GDP, is in danger of bursting. The main cause is a lack of new orders. Companies with an uncertain future are cautious about hiring new workers. The consumption price index (CPI) has fallen below the same month of the previous year for three consecutive months until December 2023.

American Bloomberg introduced a Beijing meat distributor who said that “pork prices are about 20% lower than a year ago, yet sales volume is only about two-thirds of what it was in previous years”. In response, they reported “pork demand continues to be weak. This is a sign that declining salaries are hurting household demand and dragging down consumption”. It will take some more time for the Chinese economy to revive.

5. Suggestions for the BOJ’s low interest rate strategy, “A strong yen is the dignity of Japan!“

The U.S. and Europe have raised interest rates to fight inflation after COVID-19 and have succeeded in raising wages through strikes. I would like to say a few words to Bank of Japan Governor Kazuo Ueda! “If global interest rates are going to fall anyway, I don’t dare raise them now, and I don’t need to take the risk myself!” Does Governor Ueda think that idea? Former Governor Kuroda may think that since Japan is in deflation, not inflation, there is no need to raise interest rates, but in my opinion, the reason prices did not rise in Japan is because of corporate efforts. That is because the yen was strong. Former Governor Kuroda’s zero interest rate policy for the past 10 years has achieved a correction of the appreciation of Yen ($1.00=Yen100➡$1.00=Yen140).

The U.S. and Europe have raised interest rates to fight inflation after COVID-19 and have succeeded in raising wages through strikes. I would like to say a few words to Bank of Japan Governor Kazuo Ueda! “If global interest rates are going to fall anyway, I don’t dare raise them now, and I don’t need to take the risk myself!” Does Governor Ueda think that idea? Former Governor Kuroda may think that since Japan is in deflation, not inflation, there is no need to raise interest rates, but in my opinion, the reason prices did not rise in Japan is because of corporate efforts. That is because the yen was strong. Former Governor Kuroda’s zero interest rate policy for the past 10 years has achieved a correction of the appreciation of Yen ($1.00=Yen100➡$1.00=Yen140).

A number of listed companies have revised their earnings forecasts for the fiscal year ending March 2024 upward due to the weaker yen, but leading companies are able to generate profits even with the strong yen. Despite the fact that companies have more than 500 trillion yen in retained earnings, they have been restrained from investing in human resources and raising salaries. For example, if the Japanese government had favored companies that raised salaries, the lost 30 years would have turned out rosy. Inbound visitors will come to Japan even with a strong yen as far as they are interested in Japan. However, Japan is the only country that has maintained zero interest rates. The yen’s value is being reduced by the huge amount of yen being taken out of the country by the Yen Carry Trade. As a result, the yen is weakening against all currencies. Most small and medium-sized businesses, which account for 99% of all businesses and about 70% of all employees, are suffering from the effects of the weak yen. Japan is not a special country. Interest rates and currency strength are linked. Of course, monetary strength is not only a function of interest rate differentials. The currency should be empowered to return the Japanese economy to normal economic activity. Monetary power is national power. A strong yen is the dignity of Japan.

6. Effect of the Choice of Cape of Good Hope Route on Ocean Freight Rates

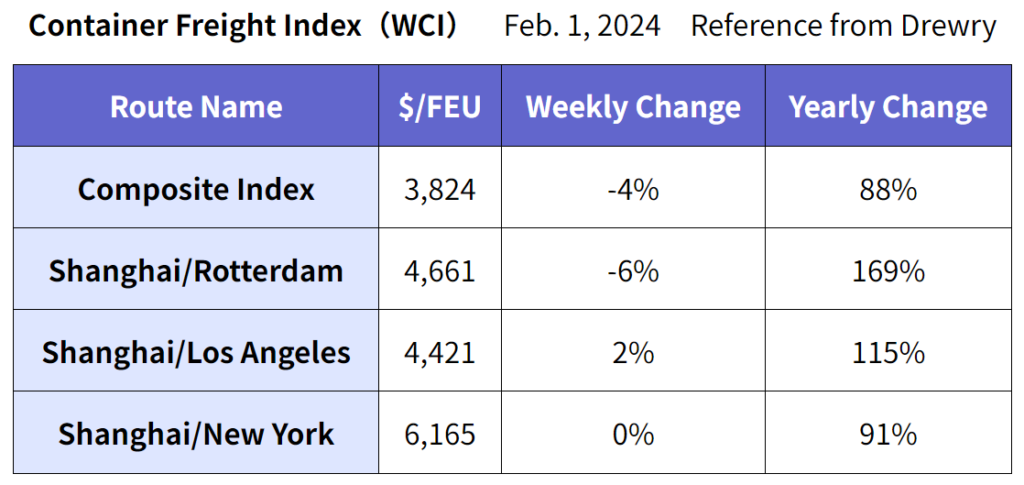

Many shipping lines have opted to divert to the Cape of Good Hope route due to the deteriorating situation in the Red Sea. Freight rates from Asia to Europe and the Mediterranean have been on an upward trend since December, but the upward momentum slowed around mid-January and turned downward in February. Drewry expects no major changes in freight rates in the near term due to the slowdown in shipments as Chinese New Year halts production in China.

7. Possibility of the Realignment of Alliances due to Hapag Lloyd’s Withdrawal from The Alliance

On January 17, Hapag-Lloyd announced that it will leave The Alliance in January 2025 and will launch a new alliance with Maersk, “Gemini Cooperation,” in February 2025. Hapag Lloyd’s departure from The Alliance has been received with surprise. The Alliance will now consist of ONE, Yang Ming, and HMM. Unfortunately, the combined size of the three companies does not reach that of either MSC or Maersk. It is being discussed to include Wan Hai Lines, which is outside the three major Alliance members. Even so, it is still not large enough to compete as one of the three Alliances. As a result, there is still a possibility of the realignment, including the Ocean Alliance.

On January 17, Hapag-Lloyd announced that it will leave The Alliance in January 2025 and will launch a new alliance with Maersk, “Gemini Cooperation,” in February 2025. Hapag Lloyd’s departure from The Alliance has been received with surprise. The Alliance will now consist of ONE, Yang Ming, and HMM. Unfortunately, the combined size of the three companies does not reach that of either MSC or Maersk. It is being discussed to include Wan Hai Lines, which is outside the three major Alliance members. Even so, it is still not large enough to compete as one of the three Alliances. As a result, there is still a possibility of the realignment, including the Ocean Alliance.

8. New Container Information in January 2024

Newly-built container prices in January were $2100 per 20f, up $100 from last month. Newly-built containers in January were 415,595 TEU (Dry: 395,878 TEU, Reefer: 19,717 TEU). Newly-built container factory inventory at the end January was 796,456 TEU (Dry: 735,133 TEU, Reefer: 61,323 TEU), down 89,077 TEU from last month. As China is currently on Chinese New Year vacation, most factories will be closed until the third week of February.

9. Impact of Prolonged Diversion via the Cape of Good Hope on Vessels Deployment & Capacity and Ocean Freight Rates

In order to not miss the great opportunity of sky-high freight rates due to a stay-at-home demand and a revenge demand during COVID-19 pandemic, shipping companies leased-in approximately 10 million TEUs or more of containers from leasing companies in China during late 2020 to early 2022. By the empty positioning of containers from surplus area to China and Asia, they would have missed the high freight cargoes, so they leased a large number of containers. Therefore, in 2023, they have concentrated on disposing of those surplus containers and returning the leased containers. However, there is still a significant surplus of leased containers because the return location and number of containers to be returned are fixed on a monthly basis. The problem is that it is difficult to bring back containers from surplus locations to China and Asia, where they are in demand, in a timely manner. Especially in winter, the number of vessels deployed has been reduced to two thirds of the ordinary season.

Due to the attacks to commercial vessels by the Houthis, a Yemeni armed group that supports the Islamic organization Hamas, shipping lines forced to suspend the transition of the Suez Canal and they diverted their route to via the Cape of Good Hope. By such decision, as their operating costs increased, ocean freight rates on the Europe-Mediterranean route were raised twice in December. Since there is a possibility that the route via the Cape of Good Hope will be prolonged after January due to the inability to ensure the safety of the Red Sea navigation, there was a trend toward fare hikes in January as well, but there was no cargo rush before the Chinese New Year as in the past. Besides, the Chinese economy is not showing its usual strength.

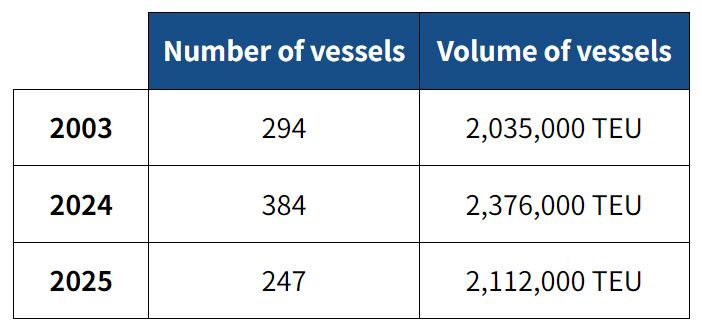

According to data from NYK Research Group, the number of newly built container vessels and the volume of new container vessels in service between 2023 and 2025 are as follows.

Many new container vessels will be delivered this year. I think the number and volume of vessels needed around the Cape of Good Hope is not a problem. I expect a soft landing for the U.S. economy. There is the Russia-Ukraine war and the conflict between Israel and Hamas, but I believe that time will solve the problems in the European economy. In the end, it will depend on the Chinese economy.

10. Launch of EFI Nagoya Representative Office

Lastly, on the topic of our company, the Nagoya Representative Office became operational in mid-January of this year. We asked Mr. Yoshimasa Goto, who worked for many years as a service dealer for Thermo King in Chubu Shizai Inc. and has reached retirement age, to take charge of the office. With his valuable experience and wide network of contacts, we are very pleased and proud to be able to provide a wide range of services to our customers in the Chubu area centering on Nagoya. We will do our best to provide even better services for our valuable customers, and we would like to ask for your continued support and cooperation.

Lastly, on the topic of our company, the Nagoya Representative Office became operational in mid-January of this year. We asked Mr. Yoshimasa Goto, who worked for many years as a service dealer for Thermo King in Chubu Shizai Inc. and has reached retirement age, to take charge of the office. With his valuable experience and wide network of contacts, we are very pleased and proud to be able to provide a wide range of services to our customers in the Chubu area centering on Nagoya. We will do our best to provide even better services for our valuable customers, and we would like to ask for your continued support and cooperation.

(Translated by Mr. Masaki Nakatsu)