Headline

1. Is the BOJ’s Continued extra-dimensional easing already at its Limit? The painful reality for the common people

2. With a simple U.S. economy, rising employment and high prices, will the Fed move to cut interest rates?

3. EU Economic Stagnation and China’s Debt Problem

4. Ocean Alliance Extension! What is ONE’s strategy for survival?

5. Background of Container Leasing Companies’ 99% over Utilization Rate

6. New Container Information for February 2024

7. EFI’s 15th Anniversary: Thanks, Prospects, and EFI’s Management Philosophy

1. Is the BOJ’s Continued extra-dimensional easing already at its Limit? The painful reality for the common people

The Minister of Internal Affairs and Communications announced on March 8 that the consumption expenditure of households of two or more persons in January this year was 289,467 yen, a 6.3% decrease from the same month last year in real terms, and this is the 11th consecutive month of year-on-year decrease. As the pay growth for general public is far behind of the rising price, there is no choice but to cut back on spending. It is clear that economic activities will not function well if this situation continues.

The Minister of Internal Affairs and Communications announced on March 8 that the consumption expenditure of households of two or more persons in January this year was 289,467 yen, a 6.3% decrease from the same month last year in real terms, and this is the 11th consecutive month of year-on-year decrease. As the pay growth for general public is far behind of the rising price, there is no choice but to cut back on spending. It is clear that economic activities will not function well if this situation continues.

Former Governor Kuroda adopted Japan’s first negative interest rate policy in January 2016 to achieve the 2% price increase target. This resulted in lower investment yields for insurance and pension funds, hurting pensioners. Dear Mr. Kazuo Ueda, Governor of the BOJ, sticking to the BOJ’s 10-year-old policy is itself being left behind the times. Do not hesitate. You should immediately stop the zero interest rate and return to the normal economic activities where interest rates are charged when borrowing money.

On the other hand, in March 2022, FRB Chairman Jerome Powell lifted the zero interest rate policy of the past two years and raised interest rates by 0.25% in order to counter inflation caused by the rebound of COVID-19 pandemic such as a Stay-at-home demand and a Revenge demand. In response, many major countries followed suit and raised interest rates to defend their currencies.

Meanwhile, Japan adopted a policy of extra-dimensional easing to supply large amounts of money to the market (the BOJ bought government bonds on a large scale) to end deflation, the yen weakened, exporters improved their performance, and stock prices rose. They also claim that employment increased by 4 million, but since the majority of the 4 million were for women and the elderly, this in effect suppressed wage growth. Meanwhile, the substantial depreciation of the yen has caused import prices to soar, forcing the general public to curb consumption in order to protect themselves. The common people are suffering. Who is the economic policy for? I don’t think that leaving things to chance is a policy. I would like to ask for an immediate correction.

The outstanding amount of ordinary government bonds that need to be redeemed at the end of 2023 is 1,070 trillion yen, and government debt has expanded to more than 2.5 times of GDP. The public finances have become unbearable for rising interest rates. Extra-dimensional easing has ruined the original function of increasing economic efficiency. I think it can be said that it has kept Japan’s zombie companies alive and turned “Japan’s lost growth” into 30 years.

2. With a simple U.S. economy, rising employment and high prices, will the Fed move to cut interest rates?

The February employment statistics released by the U.S. Department of Labor on March 8 showed that the number of nonfarm payrolls increased by 275,000 from the previous month. The unemployment rate was 3.9%, up from 3.7% in January. Still, it has been below 4% for 25 consecutive months. Average hourly earnings rose 0.1% from the previous month and 4.3% from the same month last year. This is because the U.S. employment system reduces the workforce through layoffs and early retirements when the economy turns bad, and when the economy returns, layoffs are halted or job openings begin as soon as possible. Workers change jobs based on the conditions at that time, and salaries rise dramatically. Companies also do not hesitate to add costs to their selling prices, so the rise in prices has been tremendous.

In January, there were 3.38 million job separations, which is below the level before the Corona disaster. This is evidence that the economy has already reached a plateau.

The Federal Deposit Insurance Corporation (FDIC) announced on March 7 that the delinquency and delinquency rate for U.S. bank loans was 0.86% for October-December 2023, up 0.04 points from July-September. This is the fifth consecutive quarterly increase in the delinquency rate. Particularly noticeable are commercial real estate (CRE) loans and credit card receivables. Banks and the general public are suffering from high interest rates. FRB Chairman Jerome Powell should reduce interest rates as soon as possible to ease the burden on banks and the general public in order to give the U.S. economy a soft landing.

The National Retail Federation (NRF) has released the actual and revised forecast for imports for February this year. Except for the downward revision in February, all revisions were upward: 0.3% y/y increase in January to 1.81 million TEU, 20.4% y/y increase in February to 1.86 million TEU, 5.5% y/y increase in March to 171 million TEU, 2.6% y/y increase in April to 183 million TEU, 0.3% y/y increase in May to 194 million TEU, 5.5% y/y increase in June to 193 million TEU.

About 12% of containers bound for the U.S. go through the Suez Canal, but it also brings instability and unreliability. The number of routes via the Cape of Good Hope is increasing, and the supply-demand environment has already improved with the use of newly built container vessel as additionally deployed vessels. They comment that freight market conditions are also favorable for services from Asia to the U.S. East Coast, with signs of easing in freight rate hikes.

3. EU Economic Stagnation and China’s Debt Problem

Real regional gross domestic product (GDP) for the October-December period of 2023, announced by the EU statistics office on March 8, was unchanged at zero percent from the previous quarter and fell to -0.2 percent on an annualized basis. This was the result of inflation and rising interest rates pushing down consumer spending, the Ukraine crisis cooling the economy, and lackluster exports.

Real regional gross domestic product (GDP) for the October-December period of 2023, announced by the EU statistics office on March 8, was unchanged at zero percent from the previous quarter and fell to -0.2 percent on an annualized basis. This was the result of inflation and rising interest rates pushing down consumer spending, the Ukraine crisis cooling the economy, and lackluster exports.

China’s interest payment burden has been increasing due to measures to combat the real estate recession and an increase in government and municipal bond issuance caused by deteriorating local government finances.

The interest payment burden in 2024 will increase by 7.8% year-on-year to 1.2746 trillion yuan (about ¥27 trillion), the largest ever. It appears that the Chinese economy will take time to recover.

4. Ocean Alliance Extension! What is ONE’s strategy for survival?

At the end of February, Ocean Alliance announced a five-year extension of the current agreement through 2027 to 2032. As a result, there is little chance that Ocean Alliance members will move to The Alliance.

What about ONE (Ocean Network Express)? I would like to see that ONE will appear as The Asian Alliance, in addition to Yang Ming, the remaining member of The Alliance, adding HMM and the growing Asian shipping companies to compete with the European Alliances and companies. Or, I would like to see ONE differentiate itself from its competitors by becoming an independent liner service provider making the most of its small size and sharp footwork and providing services that are unique to ONE.

5. Background of Container Leasing Companies’ 99% over Utilization Rate

On February 13, Textainer, the world’s second largest container leasing company, announced its financial results for fiscal year 2023. Textainer was merged and acquired by U.S. investment firm Stonepeak last October. The company reported revenues of $770.4 million (down 4.9% from the previous year), operating income of $372.5 million (down 21.1% from the previous year), and net income of $204.7 million (down 33.9% from the previous year). The container utilization rate for the full year 2023 remains fairly high at 98.9%. The utilization rate for 2022 is 99.4%, which is only a 0.5% drop. This high utilization rate is expected to be the same for other leasing companies.

On February 13, Textainer, the world’s second largest container leasing company, announced its financial results for fiscal year 2023. Textainer was merged and acquired by U.S. investment firm Stonepeak last October. The company reported revenues of $770.4 million (down 4.9% from the previous year), operating income of $372.5 million (down 21.1% from the previous year), and net income of $204.7 million (down 33.9% from the previous year). The container utilization rate for the full year 2023 remains fairly high at 98.9%. The utilization rate for 2022 is 99.4%, which is only a 0.5% drop. This high utilization rate is expected to be the same for other leasing companies.

The leasing company has maintained an astonishingly high utilization rate since the end of the COVID-19 pandemic. This is because, in addition to restrictions on passage through the Panama Canal due to drought, shipping companies have been forced to divert via the Cape of Good Hope due to attacks on ordinary merchant ships in the Red Sea by the Houthis, a pro-Iranian armed group in Yemen. As a result, not only they had to deploy extra vessels and containers due to the increased number of voyage days, but once they have leased containers, they are not able to return them as quickly as they would like. This is evidenced by the fact that, according to Triton, shipping lines continue to have containers in use even after long-term leases have expired, representing nearly 980,000 TEUs, or 14% of the total 7 million TEUs in their fleet. This means that shipping lines continue to use a large number of containers for several years after the termination of their long-term leases.

6. New Container Information for February 2024

Newly-built container prices for February were $2050 per 20f. Compared to the previous month, the price decreased by $50, or 2.4%. The number of newly-built containers was 251,084 TEU (Dry: 249,441 TEU, Reefer: 1,643 TEU). Compared to the previous month, the number of containers ordered decreased by 36%, of which Dry: 37% decrease and Reefer: 92% decrease. At the end of February, China’s newly-built container backlog was 730,544 TEU (Dry: 679,100 TEU, Reefer: 51,444 TEU). Compared to the previous month, the factory backlog was down 8%, of which Dry: 8% down and Reefer: 16% down. As a result, 316,996 TEUs of new containers were shipped from the factory in February.

7. EFI’s 15th Anniversary: Thanks, Prospects, and EFI’s Management Philosophy

EFI celebrated its 15th anniversary on March 2. It seems like a long time, but my impression is that it was a short time. After retirement, I rented a desk in a rental office near Higashi-Kanagawa Station and started container trading by myself because I did not want to be treated as a large size rubbish at home. In the beginning, I wondered what I would do if I invested 5 million yen in capital and received no calls or inquiries. But fortunately, the global economy recovered from the Lehman Shock in a little more than a year, and global trade started to return to normal from the beginning of 2010, which gave a boost to the container market, so that idea was groundless fear.

At first, EFI started out as a Japanese agent for a Korean company, Kukdong MES, a container dealer. Most of the staff at Kukdong MES were young, and, due to a character specific to Korean people, they treated me as an elder person with respect, which motivated me greatly. With the help of the Kukdong MES staff, our business grew steadily.

Whenever a proposal for a Japanese distributor for a foreign product or service came up, I recruited an acquaintance who could handle it, and they were happy to work for us. On the other hand, when I introduced such products to a company or staff who might buy them from a past relationship, they were happy to buy them. I still do my business in this way now, but sometimes I feel like that a strong push from someone I can’t see let me to do so.

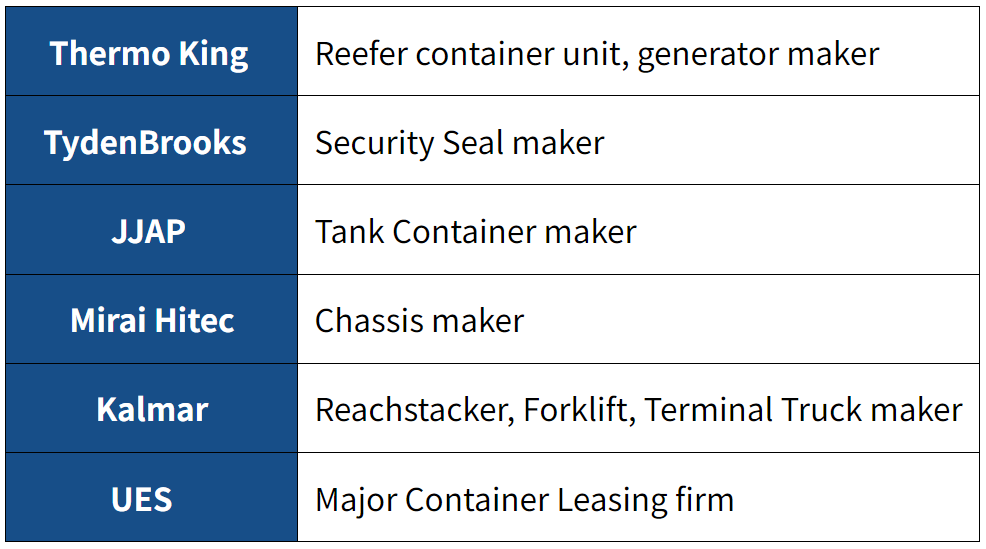

They are all major important pillars.

The staff who have joined the company have been very excellent, and now I am no longer to do in charge. Then I’m telling the staff members that until we go public, the company belongs to the staff. I want to make the company a place where the staff is happy. Each staff member wants to come to the company every day. I want to make it a company where they want to see me, the president, and the other employees every day. On the other hand, if EFI is desired to grow, we want to grow to the point where it is desired. Our current office is becoming too small for our needs, so next I would like to find an office with a good location and a large space that will please our staff.

Last but not least, I was deeply touched by the flowers, plants, and warm congratulatory telegrams we received from many customers for our company’s 15th anniversary. I would like to take this opportunity to express our deepest gratitude. Our entire staff will continue to strive to make our company a place where everyone is happy to be a part of. We sincerely hope that we can count on your further guidance and encouragement.

(Translated by Mr. Masaki Nakatsu)