Headline

1. Weak Yen Undermines Japan’s National Strength

2. US Wage Hikes Slowing, Europe Moving to Cut Interest Rates?, China hits Local Banks.

3. Container Freight Rates Fall for 10th Consecutive Week

4. Baltimore Port Accident, Little Impact on Alternative Routes

5. Cancelled Sailings to Rise, Share via Cape of Good Hope Grows to 75%.

6. New Container Information in February 2024

7. New Office Relocation and Looking for motivated people

1.Weak Yen Undermines Japan’s National Strength

On April 10th (Wednesday), on the New York foreign exchange market, the Dollar reached around $1.00=Yen 153. This is the weakest yen in 34 years since June 1990. When the U.S. went on a rate hike spree, they raised by 0.25% in March 2022, by 0.50% in December, and finally raised by 2.00% with total five increases. This shows the seriousness of their intention. European countries followed to raise interest rates accordingly. As a result, there were no significant exchange rate differences between the Euro, Pound, and the Dollar. Now both the euro and the pound are back to their pre-COVID pandemic levels. Japan, however, has been left behind because the former Bank of Japan’s Governor Kuroda maintained a zero-interest-rate policy alone.

On April 10th (Wednesday), on the New York foreign exchange market, the Dollar reached around $1.00=Yen 153. This is the weakest yen in 34 years since June 1990. When the U.S. went on a rate hike spree, they raised by 0.25% in March 2022, by 0.50% in December, and finally raised by 2.00% with total five increases. This shows the seriousness of their intention. European countries followed to raise interest rates accordingly. As a result, there were no significant exchange rate differences between the Euro, Pound, and the Dollar. Now both the euro and the pound are back to their pre-COVID pandemic levels. Japan, however, has been left behind because the former Bank of Japan’s Governor Kuroda maintained a zero-interest-rate policy alone.

In the past, central banks in Japan, the U.S., and Europe commonly adjusted interest rates by 0.25% increments. Governor Ueda raised the policy rate from -0.1% to around 0~0.1% during the Monetary Policy Meeting on March 19th. While this move is greatly to be commended, he simultaneously denied the removal of long-term interest rate suppression measures practically saying that he would continue to purchase government bonds. As a result, we cannot see the seriousness of BOJ Governor Ueda’s interest rate policy. The current situation is that the Governor himself is perceived as having denied defending the yen, spurring yen carry trade in which interest rate differentials generate profits.

According to a survey by Teikoku Databank, in 2022, there were 25,768 items, a price increase rate of 14%, and in 2023, there were 32,395 items, a price increase rate of 15%, which price were increased respectively. Additionally, in 2024, 310 items in January, 1626 items in February, 676 items in March, 1765 items in April, and 179 items in May are scheduled for price increase. No matter how much companies raise wages, they will not be able to keep up. I believe that monetary policy is essential stabilizing the yen and protecting people’s livelihoods of citizens. A weak yen weakens Japan’s national power and harms domestics businesses instead of protecting them.

2.US Wage Hikes Slowing, Europe Moving to Cut Interest Rates?, China Hits Local Banks

The number of nonfarm payrolls increased by 303,000 from the previous month in the March employment report released by the U.S. Department of Labor on April 5. The unemployment rate was 3.8%, down from 3.9% in February. The U.S. economy remains in a labor shortage. However, the number of job openings in February was 8.75 million, remaining flat and high since July 2023, and the year-on-year growth rate of average hourly earnings in March was 4.1%, down from 4.3% in February, indicating a slowdown in wage increases. As inflation rates have also declining rapidly since 2022, the U.S. economy is calming down. Meanwhile, high interest rate makes U.S. citizens hesitate to purchase new homes and sell existing homes due to high interest rates. In addition, when viewing the current situation where start-ups and venture companies, which are essential for the future of the U.S., are unable to move due to banks’ reluctance to lend money, we hope that Federal Reserve Chairman Jerome Powell will succeed in soft landing the U.S. economy by cutting interest rates as soon as possible.

The number of nonfarm payrolls increased by 303,000 from the previous month in the March employment report released by the U.S. Department of Labor on April 5. The unemployment rate was 3.8%, down from 3.9% in February. The U.S. economy remains in a labor shortage. However, the number of job openings in February was 8.75 million, remaining flat and high since July 2023, and the year-on-year growth rate of average hourly earnings in March was 4.1%, down from 4.3% in February, indicating a slowdown in wage increases. As inflation rates have also declining rapidly since 2022, the U.S. economy is calming down. Meanwhile, high interest rate makes U.S. citizens hesitate to purchase new homes and sell existing homes due to high interest rates. In addition, when viewing the current situation where start-ups and venture companies, which are essential for the future of the U.S., are unable to move due to banks’ reluctance to lend money, we hope that Federal Reserve Chairman Jerome Powell will succeed in soft landing the U.S. economy by cutting interest rates as soon as possible.

On the other hand, the European Central Bank (ECB) acknowledges the possibility of cutting interest rates in June. This is because inflation is slowing on schedule. The Eurozone consumer price index rose 2.4% y/y in March. Growth slowed for the third consecutive month. Wage increases, which affect prices, are also calming down. The U.K., Canada, and Sweden are also considering rate cuts in June. Switzerland has already implemented a rate cut in March. If the ECB moves to cut interest rates, it may lead the way of rate cuts in Europe, followed by the U.S., and the possibility of a global interest rate cut phase is emerging. However, political issues such as escalating tension between Israel and Iran, Russia’s invasion of Ukraine, soaring oil prices, and high resource prices may postpone the rate cut.

Foreign creditors have filed for legal liquidation in the Hong Kong High Court for China’s major real estate companies, China Evergrande and Country Garden. On the other hand, it is China’s local banks that have been hit hard by China’s real estate problems. The total amount of nonperforming loans for real estate of the 27 semi-major and smaller banks listed on the Hong Kong market that disclosed their financial results was 106.8 billion yuan (about 2.23 trillion yen), 27% increase from the previous year. The seriousness of the situation in the inland area, where industry is scarce and relies on infrastructure and real estate investment, is conspicuous.

According to Goldman Sachs, 75% of the financial liabilities of Chinese real estate companies are held by banks. It points out that a real estate slump could result in approx. 1.2 trillion yuan in losses, leading to capital shortage for smaller banks with unstable foundations. However, many Chinese manufacturing firms are resilient. They are aggressively selling their products around the world at competitive selling prices through mass production. The quality of Chinese products should not be underestimated.

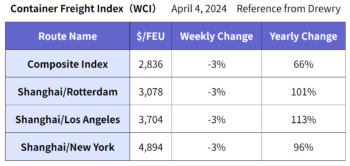

3.Container Freight Rates Fall for 10th Consecutive Week

The Container Freight Index (WCI) released by Drewry on April 4 showed that the overall index fell 3% from the previous week, $2,836 per FEU, the 10th consecutive weekly decline. As a result, spot freight rates to Shanghai/Rotterdam fell 3%, the 10th consecutive weekly decline. Shanghai/Los Angeles fell 3%, the eighth consecutive weekly decline. Shanghai/New York fell 3%, its eighth consecutive weekly decline.

Drewry expects spot freight rates to decline again this weekend.

4. Baltimore Port Accident, Little Impact on Alternative Routes

Early in the morning of March 26, a container ship collided at a bridge in Baltimore port and that has halted vessel arrivals and departures at the port, but it does not appear to have had a major impact on the container shipping market. This is because shipping companies are responding by using alternative ports such as New York/New Jersey ports, Norfolk port, and Philadelphia port, and railway companies are establishing alternative routes from Baltimore port to other ports on the East Coast of North America through dedicated rail transportation services. In addition, thanks to the hard work of the U.S. Marine Corps and others in restoring the port, Baltimore port is expected to be restored to normal operations by the end of May.

5.Cancelled Sailings to Rise, Share via Cape of Good Hope Grows to 75%.

Major container shipping lines plan to increase freight rates effective April 15. According to Drewry, between Week 15 (April 8-14) and Week 19 (May 6-12), there will be 54 overall outbound cancelled sailings on East-West routes (Pacific, Atlantic, Asia/Europe and Mediterranean). The cancellation rate corresponds to 8%. Eastbound pacific and Asia/Europe and Mediterranean routes accounted for 43% and 39%, respectively. The breakdown by alliance is 20 services for Ocean Alliance, 12 services for The Alliance, 6 services for 2M, and 16 services for non-alliance carriers.

Major container shipping lines plan to increase freight rates effective April 15. According to Drewry, between Week 15 (April 8-14) and Week 19 (May 6-12), there will be 54 overall outbound cancelled sailings on East-West routes (Pacific, Atlantic, Asia/Europe and Mediterranean). The cancellation rate corresponds to 8%. Eastbound pacific and Asia/Europe and Mediterranean routes accounted for 43% and 39%, respectively. The breakdown by alliance is 20 services for Ocean Alliance, 12 services for The Alliance, 6 services for 2M, and 16 services for non-alliance carriers.

Since the Panama Canal will enter the rainy season around May, the water shortage is expected to improve, so we expect more ships to return to the Panama Canal, at least from alternative routes such as via the Cape of Good Hope, but this will also depend on the weather. On the other hand, it seems that the Suez Canal is still difficult to navigate due to the tensed situation in the Red Sea. As a result, the share of cargo ships passing through Suez Canal decreased from 66% in November 2023 to 7% in February 2024, while the share of ships transiting the Cape of Good Hope increased from 13% to 75%.

6.New Container Information in February 2024

Newly-built container price in March was $2000 per 20f. Compared to the previous month, the price was down by $50, or 2.4%. Container production was 444,025 TEU (Dry: 429,026 TEU, Reefer: 14,999 TEU). Compared to the previous month, the number of containers manufactured was +192,941 TEU, +77% (Dry: +179,585 TEU, +72%, Reefer: 13,356 TEU, +813%).

Newly-built container backlog in China at the end of March was 788,694 TEU (Dry: 737,179 TEU, Reefer: 51,515 TEU). Factory backlog was +58,150 TEU (+7.95%), (Dry: +58,079 TEU, +8.6%; Reefer: +71 TEU, +-0%) compared to the previous month. As a result, 385,875 TEU (Dry: 370,947 TEU, Reefer: 14,928 TEU) of new containers were shipped from the factory in March. This means that 86%, 99%, and 87% of the containers manufactured in March were shipped on a Dry, Reefer, and TEU basis, respectively.

7.New Office Relocation and Looking for motivated people

We, EFI, have just celebrated our 15th anniversary and we are still a young company. We are a growing company. We are a company where each employee creates and contributes. No matter your age or gender. We are exciting company as long as you have motivations. Humans cannot live alone. We live by interacting with other people. I believe the same is true in business. It is important to make each other happy. While we may not be ancient Omi merchants, the principal of “three-way satisfaction”, benefiting the other party, oneself and society, is essential. This is what I would like to carry out. We do hope those who are willing to take on challenges, care for others, and grow together with us will join to EFI. In late July, we will be relocating to a convenient workplace, a 7-minute walk from Yokohama Station East Exit, via Bay Quarter.

We, EFI, have just celebrated our 15th anniversary and we are still a young company. We are a growing company. We are a company where each employee creates and contributes. No matter your age or gender. We are exciting company as long as you have motivations. Humans cannot live alone. We live by interacting with other people. I believe the same is true in business. It is important to make each other happy. While we may not be ancient Omi merchants, the principal of “three-way satisfaction”, benefiting the other party, oneself and society, is essential. This is what I would like to carry out. We do hope those who are willing to take on challenges, care for others, and grow together with us will join to EFI. In late July, we will be relocating to a convenient workplace, a 7-minute walk from Yokohama Station East Exit, via Bay Quarter.

Let’s work together!

(Translated by Mr. Masaki Nakatsu)