Headlines

- 1 Rebutting the “TACO” Label: The True Nature of Trump’s Diplomacy

- 2 Tariff Shock Slows Growth: OECD Downgrades Global Economic Outlook

- 3 SHIPS Act Sparks Turmoil? New Challenges for Shipping Lines

- 4 Return to the Suez: CMA CGM Leads the Way Back

- 5 After 25 Years, a National Carrier Reborn: South Africa Launches SASCO

- 6 Freight Rates Surge: WCI Climbs, but Weakness of Supply & Demand Looms in Second-Half

- 7 Wave of Oligopoly Hits Leasing Industry: Textainer to Become No.1 with Seaco Merger

- 8 New Container Information in May 2025: Leasing Demand Reignites?

- 9 Cutting Parliamentary Seats for a Better Future: Rethinking National Governance and Industry

- 10 EFI Appointed Exclusive Agent of ITALGRU, a Legacy Italian Crane Manufacturer

Rebutting the “TACO” Label: The True Nature of Trump’s Diplomacy

In U.S. financial circles, a mocking acronym for President Trump—“TACO” (Trump Always Chickens Out)—has been making the rounds, suggesting that he always backs down when things get tough. However, I believe this label is misguided. The reason is that President Trump consistently prioritizes the interests of the American people in his decision-making. A recent example came on May 12, when the U.S. and China suddenly agreed to a mutual 110% reduction in tariffs, effectively lowering U.S. import duties on Chinese goods to 30%. As someone often dubbed “Taxman,” President Trump has used tariffs as a tool to protect American industries and redirect the revenue toward tax cuts for low-income earners. However, recognizing that prolonged tariff tensions with China could harm the U.S. economy and financial markets—and by extension, the American people—he chose to de-escalate. Naturally, he must have also considered the potential negative impact on next year’s midterm elections. For China, this easing of tariffs came as a welcome opportunity to boost its domestic economy.

In U.S. financial circles, a mocking acronym for President Trump—“TACO” (Trump Always Chickens Out)—has been making the rounds, suggesting that he always backs down when things get tough. However, I believe this label is misguided. The reason is that President Trump consistently prioritizes the interests of the American people in his decision-making. A recent example came on May 12, when the U.S. and China suddenly agreed to a mutual 110% reduction in tariffs, effectively lowering U.S. import duties on Chinese goods to 30%. As someone often dubbed “Taxman,” President Trump has used tariffs as a tool to protect American industries and redirect the revenue toward tax cuts for low-income earners. However, recognizing that prolonged tariff tensions with China could harm the U.S. economy and financial markets—and by extension, the American people—he chose to de-escalate. Naturally, he must have also considered the potential negative impact on next year’s midterm elections. For China, this easing of tariffs came as a welcome opportunity to boost its domestic economy.

In another instance, when Ford Motor Company faced a serious parts shortage due to China’s export restrictions on rare earth materials, which force them temporary factory shutdowns, President Trump set aside political pride and made a direct call to President Xi Jinping. On June 5, he proposed negotiations to ease or lift the rare metal export controls that China had implemented in April. This, too, demonstrates Trump’s willingness to act decisively and pragmatically in the interest of the American economy and its people. Japanese politicians would do well to take a page from his book.

President Trump’s negotiation style is to make bold, sweeping declarations to take control of the dialogue. At the same time, he never speaks ill of his counterparts—a tactic aimed at maintaining a favorable environment for negotiation. Before the other party reaches a decision, he often expresses his own thoughts candidly via social media, using this as a tool to guide them toward agreement. His business negotiation style lies in reaching a mutually beneficial compromise at just the right moment. He engages in thorough discussions and, when he realizes he lacks full understanding, he humbly reassesses his position.

During his first presidency, President Trump notably listened to then–Prime Minister Shinzo Abe with genuine humility, a trait that was clearly visible. By understanding Trump’s personality and values, one can also better understand how to approach negotiations with him. Above all, President Trump is a man who values peace and he is not one to resort to military force.

Another defining aspect of President Trump is his commitment to eliminating waste within governments and international institutions. A prime example of this was the dismantling of USAID, the U.S. Agency for International Development, which had long provided economic and humanitarian aid to developing countries. Furthermore, he established the Department of Government Efficiency (DOGE), a temporary agency effective until July 4, 2025, led by the world’s richest man, Elon Musk, to carry out sweeping cuts to government personnel and expenditures.

Trump also announced the U.S. withdrawal from the United Nations Human Rights Council, which monitors human rights abuses; from the World Health Organization (WHO); and from the Paris Agreement, the international climate accord adopted in 2015. While his unilateral support for Israel may be controversial, I hope, by the leadership of Trump, may prompt international organizations to become more transparent and transform into more productive institutions. Regardless of whether one agrees with his approach, President Trump’s decisiveness, action-oriented mindset, and strong leadership deserve recognition.

Tariff Shock Slows Growth: OECD Downgrades Global Economic Outlook

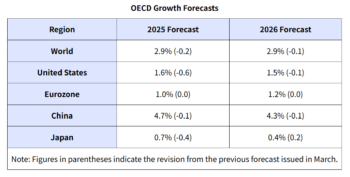

On June 3, the Organization for Economic Co-operation and Development (OECD) released its latest global growth forecast. It highlighted serious concerns over sluggish trade and investment growth, driven in part by tariff hikes implemented by the Trump administration. The report pointed to a particularly unstable situation in the United States, where economic slowdown and inflation are proceeding in tandem.

In its previous outlook released in March, the OECD had already factored in some of the tariff effects, lowering its global growth projection by 0.2 percentage points. This marks the second consecutive downward revision. The current forecast reflects tariff levels as of mid-May, and the OECD notes that future adjustments may be necessary depending on the outcomes of ongoing tariff negotiations.

The economic impact of tariffs is most severe in the United States. In 2024, the average import tariff rate stood slightly above 2%, but it has now surged to 15%—the highest level since 1938. This sharp rise is having a significant inflationary effect on domestic prices.

The OECD notes that higher tariffs are pushing up retail prices, thereby weakening consumers’ purchasing power. Furthermore, policy uncertainty is dampening both consumption and investment appetite. Countries with deep economic ties to the U.S. are also expected to experience more pronounced downside risks to their own economic outlooks.

SHIPS Act Sparks Turmoil? New Challenges for Shipping Lines

Shipping companies are no exception—they too are being swept up in President Trump’s “MAGA” (Make America Great Again) policies. In February of this year, the Office of the United States Trade Representative (USTR) announced a new port fee targeting vessels operated by Chinese shipping companies and vessels built in Chinese shipyards. Furthermore, the SHIPS for America Act, submitted to the U.S. Congress on April 30, proposes an additional levy beyond the USTR port fee. This additional charge would apply not only to Chinese carriers but also to non-Chinese shipping companies that operate fleets consisting, to a certain extent, of vessels built or repaired at Chinese or affiliated shipyards. While the USTR’s port fee is scheduled to take effect in mid-October—providing a temporary grace period—members of the Ocean Alliance, which includes Chinese carriers, are likely to face significant operational burdens due to this regulation.

Simultaneously, the Building SHIPS in America Act was also introduced to Congress with the goal of strengthening the competitiveness of the U.S. shipbuilding industry. Under this bill, shippers may be required to use U.S.-built, U.S.-flagged vessels for a portion of imports from China. This could introduce a complex and substantial cost burden for shippers.

Return to the Suez: CMA CGM Leads the Way Back

French shipping giant CMA CGM is poised to become the first major carrier to resume regular navigation through the Suez Canal. Its first vessel passed through the canal on June 28, and two more are scheduled to follow in July, as the company gradually restores standard routing. In support of this, the Suez Canal Authority announced on May 13 a temporary 15% reduction in transit fees for container ships exceeding 130,000 net tons, effective for 90 days starting May 15—an effort to incentivize carriers to return to the Suez route.

French shipping giant CMA CGM is poised to become the first major carrier to resume regular navigation through the Suez Canal. Its first vessel passed through the canal on June 28, and two more are scheduled to follow in July, as the company gradually restores standard routing. In support of this, the Suez Canal Authority announced on May 13 a temporary 15% reduction in transit fees for container ships exceeding 130,000 net tons, effective for 90 days starting May 15—an effort to incentivize carriers to return to the Suez route.

For major shipping lines, the route via Suez Canal offers significant advantages over the Cape of Good Hope route, particularly in terms of reduced operating costs and shorter lead times. However, since an estimated 6–10% of global container ship capacity has been absorbed by the longer Cape route, a sudden reallocation of vessels back to the Suez Canal could take several months. During this transition period, carriers are likely to face operational disruptions and increased rate competition due to a temporary oversupply of capacity. As a result, most carriers are not rushing to revert immediately, making CMA CGM’s return to the Suez Canal a move with potentially far-reaching implications for the industry.

After 25 Years, a National Carrier Reborn: South Africa Launches SASCO

The world’s largest container shipping company, MSC, deployed the industry’s first ultra-large 24,000 TEU container vessel to its Africa service in April. According to the company, this move was driven by a sharp increase in trade between Asia and West Africa. MSC believes that the deployment of such large vessels will enhance maritime logistics capabilities in Africa and potentially stimulate import and export activity. The company also expects this to encourage further investment in and development of port infrastructure across the region.

In accordance with the new service by MSC, on June 3, South Africa announced plans to establish a new state-owned shipping company named the South African Shipping Company (SASCO). The government aims to position maritime transport as a growth industry and develop SASCO into a full-fledged national carrier. The new company is expected to operate across four segments: container ships, crude oil tankers, chemical tankers, and dry bulk carriers.

South Africa has not had a national shipping line since 1999, when it sold its container carrier Safmarine to Maersk. Among the BRICS nations (Brazil, Russia, India, China, and South Africa), it remains the only member without a domestic carrier. As an export-oriented country, South Africa has had to rely heavily on foreign shipping companies, such as MSC, and the need to establish its own national flag fleet has been increasingly recognized.

Freight Rates Surge: WCI Climbs, but Weakness of Supply & Demand Looms in Second-Half

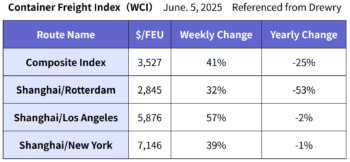

According to the World Container Index (WCI) released by Drewry on June 5, the composite index surged by 41% from the previous week to $3,527 per FEU, continuing its steep climb. Over the past four weeks, it has risen by nearly 70%. This surge has been largely driven by a sharp increase in rates on Asia–North America routes, where container demand has rebounded following the recent tariff reductions between the U.S. and China.

However, Drewry forecasts that supply-demand conditions will deteriorate again in the latter half of the year, leading to a decline in spot rates. The future trajectory of the market will also depend heavily on two factors: the outcome of U.S. judicial rulings regarding President Trump’s tariff policies, and the impact of the USTR’s proposed port fees targeting China-related vessels.

Wave of Oligopoly Hits Leasing Industry: Textainer to Become No.1 with Seaco Merger

On May 20, Textainer—currently the world’s second-largest container leasing company with a fleet of 4.5 million TEU—and its parent company, U.S.-based infrastructure investment firm Stonepeak, announced that they would acquire Seaco, another leasing company that owns 2.5 million TEU. The seller is Seaco’s parent company, Bohai Leasing.

With this acquisition, Textainer’s total operating fleet will expand to 7 million TEU, surpassing Triton—which recently sold 1.4 million TEU to Sumitomo Mitsui Finance and Leasing—and becoming the world’s largest container leasing company. The absorption of Seaco, one of the industry’s long-standing leasing firms, also marks the disappearance of another legacy brand from the container leasing market. Many of these companies were founded in the early 1970s, and their names are now fading from the industry landscape.

This development represents another step toward increased consolidation and oligopolization within the container leasing industry. It is our hope that smaller, regionally rooted leasing companies—or those with global networks capable of competing alongside the industry’s major players—will continue to grow and thrive in this evolving environment.

New Container Information in May 2025: Leasing Demand Reignites?

The price of newly built containers in May remained steady at $1,650 per 20-foot unit, unchanged from the previous month. This is notable given that the costs of raw materials—including steel and flooring—have risen by nearly 5%. It appears that container manufacturers are absorbing these additional costs themselves.

The price of newly built containers in May remained steady at $1,650 per 20-foot unit, unchanged from the previous month. This is notable given that the costs of raw materials—including steel and flooring—have risen by nearly 5%. It appears that container manufacturers are absorbing these additional costs themselves.

The total production volume of new containers in May reached 562,937 TEU, comprising 529,499 TEU of dry containers and 33,438 TEU of reefer containers. As of the end of May, the total factory inventory stood at 1,622,664 TEU (Dry: 1,562,293 TEU; Reefer: 60,371 TEU).

Compared with the previous month, total inventory increased by 47,915 TEU (Dry: +47,619 TEU; Reefer: +296 TEU). While dry container inventory saw a clear rise, reefer inventory remained largely unchanged due to nearly all produced units being shipped out. Overall, total factory inventory grew by 3% month-over-month (Dry: +3%; Reefer: ±0). It is believed that a significant portion of the inventory was deployed for shipments to the United States in the latter half of the month. As a result, the total factory stock rose 3% from the previous month.

Following a reduction in sailing frequency due to service rationalization by shipping lines, container exports from China surged after the dramatic U.S.–China tariff agreement reached on May 12. Under this deal, additional tariffs were slashed by 115%, and certain tariffs were suspended for a 90-day period. As a result, container shipments from factories in May reached the second-highest monthly volume this year, following January.

As shipping lines find it increasingly difficult to reposition their owned containers in a timely and precise manner to high-demand export regions in China, they are becoming more reliant on newly manufactured containers from leasing companies. Given this shift, the price of new containers is expected to rise in the near future.

Cutting Parliamentary Seats for a Better Future: Rethinking National Governance and Industry

Japan, too, might do well to take President Trump’s calls for reform seriously and reexamine its entrenched and stagnant political landscape. A key issue is the stark disconnect between the financial mindset of ordinary citizens and that of politicians, especially those in the ruling Liberal Democratic Party. While lawmakers often claim that politics requires money, the problem could be mitigated by fundamentally rethinking the electoral system which built on inherited electoral bases (Jiban), name recognition (Kanban), and financial backing (Kaban).

More importantly, Japan’s declining birthrate has reached a critical point. Reducing the number of parliamentary seats could be a concrete step toward reallocating public funds to support national priorities. By using these resources to revitalize domestic industries, Japan could strengthen its economic foundation and build a more resilient future.

EFI Appointed Exclusive Agent of ITALGRU, a Legacy Italian Crane Manufacturer

We, EFI, are proud to announce that we have been appointed the exclusive agent in Japan for ITALGRU, a long-established Italian manufacturer of heavy-duty cranes founded in 1954. ITALGRU has exported more than 22,000 heavy cranes worldwide. With its innovative designs, exceptional quality, and reliable service, we are confident that ITALGRU will earn your trust and satisfaction.

We, EFI, are proud to announce that we have been appointed the exclusive agent in Japan for ITALGRU, a long-established Italian manufacturer of heavy-duty cranes founded in 1954. ITALGRU has exported more than 22,000 heavy cranes worldwide. With its innovative designs, exceptional quality, and reliable service, we are confident that ITALGRU will earn your trust and satisfaction.

As with our offerings of KALMAR Reachstackers, large Forklifts, and Terminal Tractors, we sincerely ask for your continued support and patronage.