Headlines

- 1 A Second “Black Ship”? Turning the 25% Tariff Crisis into Opportunity for National Renewal through Public-Private Unity

- 2 U.S. Treasury bond Downgrade Shock: “Safe Haven” Myth Falters Amid Inflation Fears

- 3 Gradual Recovery in Europe, While Weak Policy Impact in China Casts Uncertainty Over the Economy

- 4 Suez Canal Disruptions Let Newcomers on Asia–U.S. Routes

- 5 Container Freight Rates Fluctuate Due to Trump’s Tariffs and Proposed U.S. Port Entry Fees

- 6 Five Firms Control 88%: The Rise of Oligopoly in the Container Leasing Industry

- 7 Newly Built Container Information – June 2025

- 8 Gratitude for Our Team: Staff Dedication Outshines the Summer Heat

A Second “Black Ship”? Turning the 25% Tariff Crisis into Opportunity for National Renewal through Public-Private Unity

(“Black Ship”: Please refer to the note at the end of this report.)

The U.S. reciprocal tariffs were initially scheduled to take effect on July 9. However, on July 7, President Trump announced new reciprocal tariff rates targeting 14 countries, including Japan. Despite Mr. Akazawa, Minister in charge of Economic Revitalization, having visited the United States a total of seven times between April 16 and June 26 to negotiate with U.S. cabinet officials, President Trump criticized Japan as a tough negotiator and that had been treated too leniently. If Japan fails to present any convincing measures or concessions, an additional 1% tariff—on top of the existing 24%—will be imposed starting Friday, August 1, total to 25%. Separately, a sector-specific tariff of 25% on Japanese automobiles has already been implemented since Thursday, April 3. This 25% tariff on automobiles is the very item Japan most wishes the U.S. to reduce. In 2024, approximately 1.37 million vehicles were exported from Japan to the United States, with a total export value of around JPY 6.0261 trillion. This accounts for roughly 28% of Japan’s total export to the U.S. The issue is therefore of critical importance to Japan’s economy.

The U.S. reciprocal tariffs were initially scheduled to take effect on July 9. However, on July 7, President Trump announced new reciprocal tariff rates targeting 14 countries, including Japan. Despite Mr. Akazawa, Minister in charge of Economic Revitalization, having visited the United States a total of seven times between April 16 and June 26 to negotiate with U.S. cabinet officials, President Trump criticized Japan as a tough negotiator and that had been treated too leniently. If Japan fails to present any convincing measures or concessions, an additional 1% tariff—on top of the existing 24%—will be imposed starting Friday, August 1, total to 25%. Separately, a sector-specific tariff of 25% on Japanese automobiles has already been implemented since Thursday, April 3. This 25% tariff on automobiles is the very item Japan most wishes the U.S. to reduce. In 2024, approximately 1.37 million vehicles were exported from Japan to the United States, with a total export value of around JPY 6.0261 trillion. This accounts for roughly 28% of Japan’s total export to the U.S. The issue is therefore of critical importance to Japan’s economy.

President Trump has repeatedly urged Japan to change its stance. He argues that Japan is experiencing a rice shortage that affects its citizens, yet it still refuses to import rice from the United States. He also points out that American cars are not selling well in Japan.

However, in Japan’s defense, Japan imports approximately 770,000 tons of rice annually under the World Trade Organization (WTO) “minimum access” framework. Of that total, around 350,000 tons—about 45%—are imported from the United States. Furthermore, Japan also imports approximately 20,000 American vehicles each year.

Could President Trump be a second “Black Ship” for Japan? Rather than viewing this situation as a threat, Japan could take this opportunity as a second “Black Ship” phenomenon—an impetus to mobilize industry, government, academia, and civil society to pursue structural reform and national revitalization. For example, small-scale and aging agriculture, declining forestry, and harsh fishing industries should be transformed into more attractive and vibrant sectors through safer and more efficient mechanization. Japan, as an island nation, should make strategic use of its remote islands, small and medium-sized ports, and canals by utilizing EV barges and small electric vessels. A modal shift from trucks to electric propulsion ships could revitalize port operations and energize regional harbors. Attractive ports would not only create local employment opportunities but also help reduce the overconcentration of population and economic activity in Tokyo.

Furthermore, by promoting new technologies and policies related to renewable energy, Japan could accelerate the adoption of electric vehicles and the electrification of various types of machinery. Through such efforts, Japan could aim to promote the sustainable revitalization of Japan with a long-term plan of 30 to 50 years?

Before embarking on such long-term initiatives, it is essential for Japan to negotiate a reduction in the current tariffs to levels it can accept. One proposal could be to replace government-owned official vehicles with well-known American car brands. This measure would require minimal cost but could deliver a significant symbolic impact to President Trump. In addition, Japan might consider replacing the entire annual “minimum access” rice import quota with U.S.-grown rice—or even boldly increasing the quota to one million tons as a goodwill gesture. Given that China has halted its purchases of U.S. wheat, Japan could also announce that it will import the wheat covered under its tariff-rate quota for the U.S. at zero tariffs.

Furthermore, over 200 million tons of manganese nodules containing rare metals have been confirmed in deep-sea deposits located at a depth of 5,500 meters off the coast of the Ogasawara Islands and Minamitorishima (Tokyo), within Japan’s Exclusive Economic Zone (EEZ). Japan plans to conduct technical demonstration tests for extraction by 2027. Why not propose a joint commercial development project to President Trump? China has refused to acknowledge Japan’s EEZ around Minamitorishima and has already begun independent deep-sea resource surveys in the adjacent seas. Therefore, a Japan–U.S. joint development initiative would also serve as a strategic countermeasure to China’s activities. Such cooperation could benefit the United States in its efforts to counter China’s restrictive rare metal export policies. At the very least, these proposals could help shift the mindset of the often difficult-to-persuade President Trump—and possibly lead to a significant reduction in the current 25% tariff on automobiles and the 25% reciprocal tariffs.

On July 20, the House of Councill election will be held during Japan’s three-day weekend, and it seems that all attention is focused on the domestic political agenda. Given this context, Prime Minister Ishiba’s response to President Trump’s 25% tariffs—merely expressing “deep regret”—unfortunately fails to convey a strong sense of determination or urgency in defending Japan’s interests, despite his repeated negotiation efforts.

U.S. Treasury bond Downgrade Shock: “Safe Haven” Myth Falters Amid Inflation Fears

In May, Moody’s Ratings, one of the world’s major credit rating agencies, downgraded the U.S. government’s credit rating by one notch from the highest level. Additionally, a U.S. research firm reported that $10 billion (approximately JPY 1.45 trillion) flowed out of U.S. long-term bond funds, including Treasury and corporate bonds, during the April–June quarter. These capital outflows are seen as a warning sign of deteriorating fiscal stability. Central banks and institutional investors worldwide are shifting their holdings from U.S. Treasuries to gold, which is increasingly regarded as a safer asset.

On July 4, the U.S. Congress passed and enacted a new tax and spending bill centered on the extension of the Trump tax cuts. The Congressional Budget Office (CBO) projects that this measure will result in a cumulative fiscal deficit of approximately $3.4 trillion (about JPY 490 trillion) over the next ten years. In light of this outlook, financial markets are increasingly alarmed by the rapid expansion of U.S. debt. The large-scale issuance of government bonds is expected to exert inflationary pressure, and there is growing concern that the erosion of the “safe haven” status of U.S. Treasuries could further weaken the country’s fiscal foundation.

Gradual Recovery in Europe, While Weak Policy Impact in China Casts Uncertainty Over the Economy

The European economy continues to show signs of a gradual recovery; however, momentum remains weak, and persistent risks such as trade frictions and geopolitical tensions could further dampen growth. The European Union (EU) has approved Bulgaria’s adoption of the single currency, the euro, with implementation scheduled for January 1, 2026. This marks the first addition to the eurozone since Croatia joined in 2023.

According to the Nikkei newspaper, China’s real Gross Domestic Product (GDP) grew by 5.0% year-on-year during the April to June quarter of 2025. While trade tensions with the United States continue to weigh on growth, strong exports to Southeast Asia provided some support. Signs of a recovery in consumer spending have begun to emerge. However, the Chinese economy still faces deflationary pressure, sluggish exports, and structural weaknesses in the real estate and labor markets. Although government stimulus measures have led to modest improvements in home sales in severel major cities, the real estate market in regional cities remains under significant strain. For now, China has avoided a sharp economic downturn, but a full-fledged recovery has yet to materialize.

Suez Canal Disruptions Let Newcomers on Asia–U.S. Routes

On July 6 and 7, commercial vessels were attacked in the southern Red Sea. The Iran-backed Houthi militant group in Yemen claimed responsibility for the July 6 attack. While CMA CGM continues to transit the Suez Canal under escort by the French Navy, it appears unlikely that major alliance carriers will resume full-scale transits through the canal in the near term.

On July 6 and 7, commercial vessels were attacked in the southern Red Sea. The Iran-backed Houthi militant group in Yemen claimed responsibility for the July 6 attack. While CMA CGM continues to transit the Suez Canal under escort by the French Navy, it appears unlikely that major alliance carriers will resume full-scale transits through the canal in the near term.

In the aftermath of the COVID-19 pandemic and amid surging freight rates on trans-Pacific routes, several container shipping lines—both new players and returning players—are entering the market:

=Korea Marine Transport Co. (KMTC) – A Korean carrier

In mid-June, KMTC re-entered the market in partnership with TS Lines and Sealead Shipping.

=Emirates Shipping Line – Partnership with UWL

In late July, Emirates will launch services connecting Ho Chi Minh City, Shekou, and Seattle.

=HDT International Shipping – A Hong Kong-based carrier

In mid-July, HDT is planning to launch a fast service between Nansha (China) and Los Angeles, with a transit time of approximately 14 days.

=China United Lines (CUL) – A Chinese carrier

On 17th June, CUL started service between Shekou, Ningbo, Qingdao, and Los Angeles.

However, the viability of these new entrants on Asia–U.S. routes may be affected by President Trump’s tariff policies and proposed port entry fees by the U.S. Trade Representative (USTR), potentially prompting service changes or early market exits.

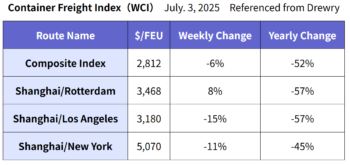

Container Freight Rates Fluctuate Due to Trump’s Tariffs and Proposed U.S. Port Entry Fees

Drewry forecasts that the supply-demand balance in the container shipping market will deteriorate again in the second half of this year, likely resulting in a decline in short-term container freight rates. While the magnitude and timing of the rate decline remain uncertain, Drewry notes that future developments will largely depend on any import tariffs imposed by President Trump and the port entry fees the U.S. may apply to Chinese tonnage.

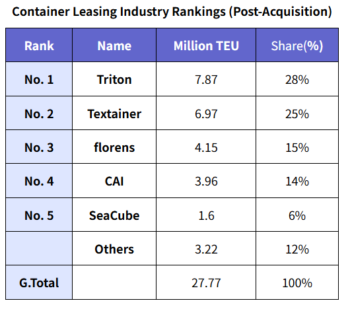

Five Firms Control 88%: The Rise of Oligopoly in the Container Leasing Industry

There is growing interest in the current power dynamics among container leasing companies. In March 2025, Triton acquired the U.S.-based leasing company GCI, which owns approximately 500,000 TEU. Additionally, Mitsui Sumitomo Finance & Leasing Company formed a joint venture with Brookfield —Triton’s parent company— and acquired a 20% stake in Triton. Triton continues to manage its entire fleet, now operating approximately 7.5 million TEU, including GCI’s 500,000 TEU.

There is growing interest in the current power dynamics among container leasing companies. In March 2025, Triton acquired the U.S.-based leasing company GCI, which owns approximately 500,000 TEU. Additionally, Mitsui Sumitomo Finance & Leasing Company formed a joint venture with Brookfield —Triton’s parent company— and acquired a 20% stake in Triton. Triton continues to manage its entire fleet, now operating approximately 7.5 million TEU, including GCI’s 500,000 TEU.

Meanwhile, Textainer has agreed to acquire Seaco from Bohai Leasing. Drewry has published an updated overview of the container leasing industry landscape in light of these acquisitions.

As of the end of 2024, just five container leasing companies collectively own over 88% of the global leased container fleet (based on TEU), and control 48% of all containers in use worldwide.

Newly Built Container Information – June 2025

The price of newly built containers in June rose to $1,700 per 20-foot unit, marking a $50 increase from the previous month. This price hike was driven by a 3% increase in flooring material costs, which outweighed a 1% decline in steel prices.

The total production volume of new containers in June reached 625,825 TEU, consisting of 588,292 TEU of dry containers and 37,533 TEU of reefers. Compared to the previous month, production increased by 62,888 TEU in total (Dry: +58,793 TEU; Reefer: +4,095 TEU), representing an 11% overall increase (Dry: +11%; Reefer: +12%).

As of the end of June, factory backlog inventory stood at 1,633,837 TEU (Dry: 1,570,374 TEU; Reefer: 63,463 TEU). This increase likely reflects preparations for the peak summer shipping season. Compared to the previous month, total factory inventory increased by 11,173 TEU (Dry: +8,081 TEU; Reefer: +3,092 TEU), representing a 0.7% rise overall (Dry: +0.5%; Reefer: +5.1%).

Factory shipments in June totaled 614,652 TEU, consisting of 580,211 TEU of dry containers and 34,441 TEU of reefers. This suggests that nearly all containers produced in June—both dry and reefer types—were shipped during the same month.

Gratitude for Our Team: Staff Dedication Outshines the Summer Heat

The intense summer heat these days makes it difficult to stay focused. It’s amusing how we are never quite satisfied—when it’s hot, I find myself wishing for winter, and when it’s cold, I long for summer. When I was younger, I used to get excited just before summer approached, looking forward to the season with eager anticipation. But with today’s extreme heatwaves, that excitement has faded, and now I simply seek refuge in the cool air of an air conditioner.

I’m reminded of a time during business trips to Hong Kong and Singapore. I recall how local staff would joyfully stand under a strong blast of air conditioning and exclaim, “Oh, fresh! Fresh!” It struck me how, for those living in hot climates, artificially cooled air can feel as refreshing as a mountain breeze.

Of course, there’s no use complaining about nature—but every time I hear our staff report a successful deal or product order, the oppressive summer heat seems to vanish in an instant. To all our hardworking team members—I am deeply grateful. Thank you, truly.

Note: “Black Ships”

The arrival of the “Black Ships” refers to the event in 1853 (Kaei 6), when Commodore Matthew Perry led a fleet of four U.S. Navy vessels, including two steam-powered warships from the East India Squadron, to Japan.

The fleet anchored off the coast of Uraga, at the entrance of Edo Bay (Yokosuka City, Kanagawa Prefecture), and some of the ships, under the pretext of conducting surveys, advanced deep into the bay.

As a result, the Tokugawa shogunate allowed Perry and his delegation to land at Kurihama, where they delivered a letter from the President of the United States. This event ultimately led to the signing of the Treaty of Peace and Amity between Japan and the United States the following year and Japan finally ended isolation and opened the country to the world.

In Japan, the period from this incident until the restoration of imperial rule is commonly referred to as the Bakumatsu (the end of the Tokugawa shogunate).

(Translated by Y. Tokuyama)