Headlines

- 1 15% Tariff Settlement with the U.S. – The True Nature of the Japan’s Concession which Shakes Japanese Economy

- 2 Global Economy in Flux: U.S. “Slowing Job Growth,” EU “Tariff Relief Leads Economy Stimulus,” China “Economic Downturn”

- 3 First in the U.S. History: Transcontinental Rail Network Born, Reshaping the Supply Chain

- 4 Houthi Attacks Resume – Cape of Good Hope Detour Becoming the New Normal

- 5 Container Freight Rates Fall for 7 Consecutive Weeks – Future Market Hinges on Trump’s Tariff and Policies?

- 6 Sharp Decline in Transpacific Vessel Capacity – A New Era of 10-Carrier Oligopoly in Global Shipping

- 7 New Container Information for July 2025 – Prices Unchanged, Factory Inventory on the Rise

- 8 Return to Matsumoto After 60 Years – Memories of a Wandervogel Trek and New Scenery of Inbound Tourists

15% Tariff Settlement with the U.S. – The True Nature of the Japan’s Concession which Shakes Japanese Economy

On July 22, the Ishiba administration reached an agreement with U.S. President Trump to impose reciprocal tariffs of 15% on automobiles and auto parts. This agreement will take effect on August 7. In 2024, Japan exported 1.37 million vehicles to the United States. The total export value to the U.S. was ¥21 trillion, with ¥7.2 trillion—or one-third—coming from automobiles and auto parts. With the 15% tariff in place, some estimates suggest that the total impact of Japan’s seven major automakers will be reduced by 46%, from 3.47 trillion yen to 1.89 trillion yen. However, Japanese automakers appear confident that they can absorb the impact through internal efforts.

On July 22, the Ishiba administration reached an agreement with U.S. President Trump to impose reciprocal tariffs of 15% on automobiles and auto parts. This agreement will take effect on August 7. In 2024, Japan exported 1.37 million vehicles to the United States. The total export value to the U.S. was ¥21 trillion, with ¥7.2 trillion—or one-third—coming from automobiles and auto parts. With the 15% tariff in place, some estimates suggest that the total impact of Japan’s seven major automakers will be reduced by 46%, from 3.47 trillion yen to 1.89 trillion yen. However, Japanese automakers appear confident that they can absorb the impact through internal efforts.

On the other hand, Japan made significant economic concessions. The Japanese government pledged to expand direct investment in the U.S. through a government-backed financing program totaling up to $550 billion (approximately ¥80 trillion). Japan also committed to increasing imports of U.S. automobiles, boosting imports of U.S.-grown rice by 75%, raising its annual defense spending from $14 billion to $17 billion, and purchasing 100 aircraft from Boeing.

This outcome was not so much the result of Mr. Ishiba’s efforts as it was the scenario envisioned by President Trump from the outset. In the 1990s, the U.S. accounted for 30% of Japan’s total exports, but today that share hovers around 20%. The U.S. market remains highly attractive to Japan. While it is considerably significant to have secured the export market, taking this good opportunity, Japan should boost domestic demand and step up efforts to develop markets in Asian countries closer to home.

Global Economy in Flux: U.S. “Slowing Job Growth,” EU “Tariff Relief Leads Economy Stimulus,” China “Economic Downturn”

According to the U.S. Department of Labor’s employment report released on August 1, nonfarm payrolls rose by 73,000 in July compared to the previous month. However, this figure fell short of market expectations, and the job growth figures for May and June were sharply revised downward—from around 140,000 to just a few tens of thousands per month. In response, President Trump dismissed the head of the Bureau of Labor Statistics, accusing the official of deliberately manipulating the data.

Many believe that the deterioration in employment conditions is largely a result of President Trump’s own policies. The unemployment rate was 4.2%, in line with market expectations, but up from 4.1% in June. With U.S. economic growth slowing, concerns are mounting over rising burdens on households, long-term economic contraction, and increasing uncertainty in the overall outlook.

On July 28, the European Union (EU), through negotiations with U.S. President Trump, agreed to a series of concessions, including $750 billion (approximately ¥110 trillion) in energy imports from the United States to reduce reliance on rival Russia, more than $600 billion in direct investments into the U.S., and the eventual elimination of tariffs on U.S. products, beginning with a phased removal of tariffs on American automobiles. These concessions enabled the EU to negotiate a reduction in reciprocal and automobile tariffs from 30% to 15%.

Among the 27 EU member states, the 20 countries comprising the Eurozone recorded real GDP growth of only 0.1% in the April–June quarter compared to the previous quarter, translating to an annualized growth rate of 0.4%—a sharp drop from 2.3% in the January–March period. With reciprocal tariffs between the EU and the U.S. set to take effect on August 7, consumer spending and corporate investment in Europe are expected to recover, and potentially revitalize the European economy.

China’s reciprocal tariff agreement with the United States was set to expire on August 12. However, during ministerial-level talks held in Stockholm on July 29, both sides agreed to extend the agreement by 90 days. As part of the extension, the current tariff rates will remain unchanged: 30% on Chinese exports to the U.S. and 10% on U.S. exports to China.

On July 31, China’s National Bureau of Statistics announced that the country’s Manufacturing Purchasing Managers’ Index (PMI) for July was 49.3, down 0.4 points from the previous month. It stayed below the key 50-point threshold—indicating contraction—for the fourth consecutive month. Prolonged weakness in domestic demand and ongoing trade tensions with the U.S. have further dampened business sentiment.

The Chinese government has begun construction of a massive dam in the Tibet Autonomous Region, which is expected to become the world’s largest in terms of power generation capacity. The total investment in the project amounts to 1.2 trillion yuan (approximately ¥25 trillion). This initiative forms part of China’s domestic economic stimulus efforts and also aims to reduce coal dependence as part of its broader decarbonization strategy. However, since the river on which the dam is being built flows through India and Bangladesh before reaching the Bay of Bengal, there are growing concerns that the project could spark renewed tensions with India.

Meanwhile, China Evergrande Group, a major real estate developer currently undergoing restructuring, is on the verge of being delisted from the Hong Kong Stock Exchange. As of the end of June 2023, the company had a negative net worth of 644.2 billion yuan (approximately ¥13 trillion), with total liabilities amounting to 2.3882 trillion yuan (around ¥50 trillion). The crisis in China’s real estate sector is deeply rooted, and the government is increasingly wary of a resurgence in financial instability.

First in the U.S. History: Transcontinental Rail Network Born, Reshaping the Supply Chain

On July 29, U.S. rail giant Union Pacific Railroad (UP) announced an agreement to acquire another major American rail company, Norfolk Southern (NS), in a deal valued at $85 billion (approximately ¥12 trillion). The merger will establish the first U.S. transcontinental railroad operated by a single company. It will significantly reduce cargo transfers between the two networks, enabling a more efficient logistics system for shippers.

On July 29, U.S. rail giant Union Pacific Railroad (UP) announced an agreement to acquire another major American rail company, Norfolk Southern (NS), in a deal valued at $85 billion (approximately ¥12 trillion). The merger will establish the first U.S. transcontinental railroad operated by a single company. It will significantly reduce cargo transfers between the two networks, enabling a more efficient logistics system for shippers.

The unified rail system will provide seamless transportation across more than 50,000 miles of track spanning 43 states, from the U.S. East Coast to the West Coast. It will connect around 100 ports and serve nearly all regions of North America. The companies stated that the merger will reshape the U.S. supply chain, revitalize the manufacturing sector, and drive economic growth and job creation. They also projected $2.75 billion in annual synergies from the integration.

Houthi Attacks Resume – Cape of Good Hope Detour Becoming the New Normal

On July 27, Yemen’s armed Houthi group launched a new military campaign, declaring that all vessels calling at Israeli ports would be targeted for attack. The Houthis had suspended their assaults on commercial ships navigating the Red Sea between January and June this year, following a temporary ceasefire between Israel and Hamas in early January. However, after Israel’s strike on Iran on June 13, the Houthis resumed attacks on commercial vessels in the Red Sea in early July.

A commercial vessel sank during the attacks. It was registered in Greece and had no confirmed trade relationship with Israel, prompting observers to conclude it was an indiscriminate attack. As a result, container ship traffic through the Suez Canal is likely to remain suspended until the safety of crews can be guaranteed. For the time being, vessels will continue to take the alternative route via the Cape of Good Hope.

Container Freight Rates Fall for 7 Consecutive Weeks – Future Market Hinges on Trump’s Tariff and Policies?

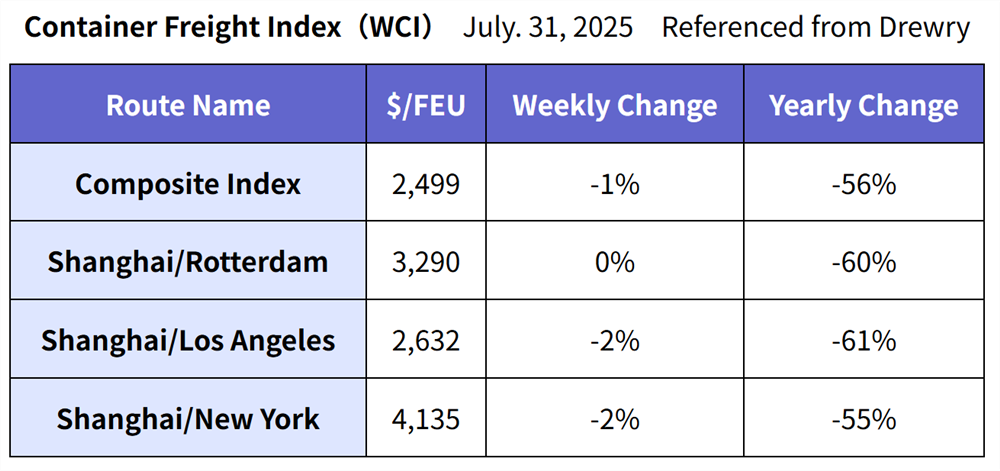

On July 31, Drewry released its latest World Container Index (WCI), showing a 1% week-on-week decline to $2,499 per FEU. This marked the seventh consecutive weekly drop. Although freight rates fell sharply through mid-July, the pace of decline has since begun to slow.

The Shanghai–Rotterdam rate rose slightly to $3,290 per FEU. The Shanghai–Los Angeles route had been rising steadily until early June but has since recorded seven consecutive weekly declines, ranging from 2% to 20%. As of July 31, the rate stood at $2,632 per FEU, down 2% from the previous week. The Shanghai–New York rate also fell by 2% to $4,135 per FEU, marking the seventh straight week of declines, with weekly drops between 2% and 13%.

Drewry forecasts that the supply-demand balance will deteriorate again in the latter half of the year, leading to a further decline in short-term container freight rates. Although the exact scale and timing of these rate fluctuations remain uncertain, Drewry notes that they will largely depend on the impact of President Trump’s import tariffs and U.S.-imposed port charges on China-flagged vessels.

Sharp Decline in Transpacific Vessel Capacity – A New Era of 10-Carrier Oligopoly in Global Shipping

According to Danish maritime analytics firm Sea-Intelligence, as of May 30, shipping lines had planned to deploy an additional 770,000 TEU of capacity on Asia–Pacific routes during June and July in response to U.S. importers’ rapid advance purchases of Chinese goods. However, by July 4, due to a sudden revers shift of U.S. importers, carriers scaled back 23% of the planned capacity—reducing the additional volume to 590,000 TEU. On the North America East Coast routes, carriers initially planned to add 348,000 TEU in total for June and July, but by July 4, they had reduced that by 24%, bringing the added capacity down to 265,000 TEU. Despite these adjustments, both trade lanes have seen a sharp drop in spot freight rates, driven by a combination of weakening demand and growing vessel capacity.

Sea-Intelligence also analyzed the concentration of fleet share among the world’s top 10 container carriers (excluding Hanjin Shipping, which went bankrupt in 2016). These carriers—MSC, Maersk, CMA CGM, COSCO, Hapag-Lloyd, ONE, Evergreen, HMM, ZIM, and Yang Ming—collectively controlled 55% of global fleet capacity in 2010. This share is projected to rise to 86% by 2025. MSC has secured its position as the world’s largest carrier with a fleet capacity of approximately 6.7 million TEU, without engaging in any mergers or acquisitions. This increase reflects MSC’s gain of market share lost by companies like Maersk and COSCO.

New Container Information for July 2025 – Prices Unchanged, Factory Inventory on the Rise

The price of newly built containers in July remained unchanged at $1,700 per 20f, the same as in June. This was despite an 8.4% decline in steel prices and a 2.4% increase in paint prices, indicating that container manufacturers absorbed the cost differences.

Total production of new containers in July reached 704,331 TEU, comprising 670,423 TEU of dry containers and 33,908 TEU of reefer containers. Compared to the previous month, this represents an increase of 78,506 TEU overall (Dry: +82,131 TEU; Reefer: -3,625 TEU), corresponding to a growth rate of +13% (Dry: +14%; Reefer: -10%).

Factory inventories of newly built containers stood at 1,693,232 TEU at the end of July (Dry: 1,635,926 TEU; Reefer: 57,306 TEU). The sharp increase in container exports from China is believed to have been driven by the unexpected 90-day extension—until August 12—of the U.S.-China reciprocal tariff measures announced in May.

Compared to the previous month, factory inventories increased by a total of 59,395 TEU (Dry: +65,552 TEU; Reefer: -6,157 TEU), translating to a 3.6% overall increase (Dry: +4.2%; Reefer: -9.7%).

In July, total factory shipments amounted to 644,936 TEU (Dry: 604,871 TEU; Reefer: 40,065 TEU). Dry container shipments represented 90% of new production, while reefer container shipments exceeded new production by 118%.

Return to Matsumoto After 60 Years – Memories of a Wandervogel Trek and New Scenery of Inbound Tourists

At the end of July, I took three days off for summer vacation and went on a family trip to Matsumoto City in the Shinshu region. We took the Azusa No. 9 limited express from Shinjuku Station, and the journey—about two and a half hours in a fully air-conditioned, comfortable train—was very pleasant.

Nearly 60 years ago, when I was a freshman in university, I was a member of the Wandervogel Club and participated in the summer training camp: a 12-day traverse of the Northern Alps with 10 members in total, including five first-year students. We left Shinjuku Station at 11 p.m. on an overnight local train bound for Matsumoto. Arriving around 6 a.m., we then took a bus from Matsumoto Station to Kamikochi. With the Azusa River and Taisho Pond on our left, we arrived in Kamikochi, pitched our tents near Kappa Bridge, joined another team’s campfire along the Azusa River, and prayed for a safe journey ahead.

Early the next morning, carrying 30kg backpacks, we made a steep ascent to our base camp in Karasawa. I still remember suffering from a terrible headache due to altitude sickness when we arrived. After setting up our tents, I had to take a two-hour nap to recover. Our plan was to traverse Nishihotakadake, Maehotakadake, Okuhotakadake, and Kitahotakadake, then stay overnight at a mountain lodge near Mt. Yarigatake. On July 31, the day after setting up camp in Karasawa, we climbed to the Nishihotaka Doppyo. I recalled scaling the rocky terrain, gripping thick chains. The next day, after summiting Nishihotakadake, we began our descent. Below the sea of clouds, we could see and hear lightning. Eventually, rain started to fall, and we cautiously made our way down, step by step, clad in ponchos.

Looking back now, I had no idea at the time that a tragic accident had occurred that very same day—July 31—when 11 high school students from Matsumoto lost their lives to a lightning strike. As I recalled the experience, it felt like I was instantly transported across more than 60 years of time, and I couldn’t stop my tears.

The city of Matsumoto was bustling with overseas visitors, many of whom appeared to be serious mountain trekkers. At our hotel, international guests—couples, families, and groups of friends—happily enjoyed Japanese cuisine served buffet-style. Even in the large communal baths and open-air hot springs, numerous foreign visitors were clearly relishing the experience. Every soba restaurant, a Shinshu specialty, was crowded with long queues, often requiring waits of over an hour. Securing a dinner reservation proved challenging, and even at the restaurant we finally managed to book, many foreign guests were savoring their meals.

At every destination—Matsumoto Castle, the Matsumoto City Museum of Art, and the former Kaichi School building—we saw large numbers of overseas visitors sharing their experiences on social media and showing greater curiosity and enthusiasm for Japan’s regional cities than many domestic tourists. This experience reaffirmed for me the importance of re-evaluating the appeal of our rural areas, revitalizing them, and reducing the overconcentration of population and resources in Tokyo.

(Translated by Y. Tokuyama)