Headlines

- 1 U.S. Economy Hits the Brakes: Consumption and Employment Stagnation Slow Growth to 1%

- 2 China Takes the Lead in Renewable Energy—What Strategy Should Japan Pursue?

- 3 From Threat to Awe: China’s Shipbuilding Power Surges Despite Regulatory Pressures

- 4 Container Freight Rates Fall for 12 Consecutive Weeks, Supply-Demand Imbalance Becomes Clear

- 5 HMM, the World’s 8th Largest Carrier, Faces Renewed Turmoil Over Buyout Bids

- 6 Newly Built Container Information—Production Declines, Export Demand Pauses

- 7 Reefer Containers Hold the Key to Revitalizing Local Communities and Economy: Job Creation and Regional Development

U.S. Economy Hits the Brakes: Consumption and Employment Stagnation Slow Growth to 1%

The Federal Reserve Board (FRB) released its Beige Book on the 3rd, summarizing that economic activity across most districts in the United States showed little change from early July. Due to uncertainties surrounding tariff policy, many companies have been hesitant to expand employment, while wages have failed to keep pace with rising prices. As a result, personal consumption—which accounts for about 70% of U.S. nominal GDP—has remained flat to declining. Supporting this view, the U.S. Department of Labor announced on the 5th that non-farm payrolls in August increased by only 22,000 from the previous month, falling short of market expectations of 80,000. It was also revealed that revised figures for U.S. employment over the past year through March 2025 were significantly lower than the initially reported numbers. The unemployment rate rose from 4.2% in July to 4.3%. Excluding the pandemic year of 2020, this marked the first decline in employment since September 2010. Concerns over the U.S. economic outlook have been spreading in financial markets, and an interest rate cut at the Federal Open Market Committee (FOMC) meeting scheduled for September 16–17 is now widely anticipated. Having driven the global economy with a 3% growth rate in the post-pandemic years, the U.S. economy is expected to slow to around 1% in 2025.

The Federal Reserve Board (FRB) released its Beige Book on the 3rd, summarizing that economic activity across most districts in the United States showed little change from early July. Due to uncertainties surrounding tariff policy, many companies have been hesitant to expand employment, while wages have failed to keep pace with rising prices. As a result, personal consumption—which accounts for about 70% of U.S. nominal GDP—has remained flat to declining. Supporting this view, the U.S. Department of Labor announced on the 5th that non-farm payrolls in August increased by only 22,000 from the previous month, falling short of market expectations of 80,000. It was also revealed that revised figures for U.S. employment over the past year through March 2025 were significantly lower than the initially reported numbers. The unemployment rate rose from 4.2% in July to 4.3%. Excluding the pandemic year of 2020, this marked the first decline in employment since September 2010. Concerns over the U.S. economic outlook have been spreading in financial markets, and an interest rate cut at the Federal Open Market Committee (FOMC) meeting scheduled for September 16–17 is now widely anticipated. Having driven the global economy with a 3% growth rate in the post-pandemic years, the U.S. economy is expected to slow to around 1% in 2025.

China Takes the Lead in Renewable Energy—What Strategy Should Japan Pursue?

Record-breaking heatwaves have been observed across the globe, with severe damage reported from extreme heat. The frequency of tropical cyclones, typhoons, and heavy rainfall has been increasing, leading to river overflows, large-scale flooding, and prolonged droughts in various regions, all of which have caused serious impacts on agriculture and livestock industries. Furthermore, widespread wildfires, inundation and saltwater damage in small island nations and low-lying coastal areas have forced residents to relocate. If greenhouse gas emissions continue at the current pace, global average temperatures are projected to keep rising through the mid-21st century, with worst-case scenarios pointing to an increase of up to 5.7℃ by the year 2100.

Record-breaking heatwaves have been observed across the globe, with severe damage reported from extreme heat. The frequency of tropical cyclones, typhoons, and heavy rainfall has been increasing, leading to river overflows, large-scale flooding, and prolonged droughts in various regions, all of which have caused serious impacts on agriculture and livestock industries. Furthermore, widespread wildfires, inundation and saltwater damage in small island nations and low-lying coastal areas have forced residents to relocate. If greenhouse gas emissions continue at the current pace, global average temperatures are projected to keep rising through the mid-21st century, with worst-case scenarios pointing to an increase of up to 5.7℃ by the year 2100.

Despite these conditions, U.S. President Trump has withdrawn from the Paris Agreement, shifting away from strengthened climate action. His administration has imposed restrictions on clean energy development such as offshore wind power, and has scaled back or reconsidered tax incentives and subsidy programs for electric vehicles (EVs), thereby reinforcing a return to fossil fuels.

By contrast, the European Union, following Russia’s invasion of Ukraine in February 2022, reduced its reliance on Russian natural gas as part of its sanctions and accelerated the introduction of alternative and renewable energy sources. Until then, the EU had depended on Russia for 60% of its fossil fuel supply. Since then, the EU has rapidly expanded alternative energy sources—including renewables and nuclear—driving a major transformation in the power sector. In the first half of 2024, renewable energy (wind, solar, hydro, biomass, etc.) accounted for 50% of total electricity generation in the EU. Wind power has already overtaken natural gas to become the second-largest source of power after nuclear energy.

Unlike solar power, which operates only during daylight hours, wind power can generate electricity year-round, operating 365 days a year whenever the wind blows. However, the wind power sector—particularly offshore wind power—has been facing major challenges worldwide. In the case of offshore wind, soaring equipment and construction costs have pushed capital investment and maintenance expenses to more than 1.5 times those of onshore wind. As a result, offshore wind developers across the globe have been suspending projects, merging operations, or withdrawing altogether due to deteriorating profitability and capital losses.

Orsted, the Danish offshore wind giant, has seen its business profitability worsen under the combined pressures of inflation, rising interest rates, the COVID-19 pandemic, and Russia’s invasion of Ukraine. To sustain operations, Orsted secured up to 6 billion Danish kroner (approximately JPY 140 billion) in additional funding from Norwegian oil major Equinor. In 2024, Equinor had already invested USD 2.5 billion (around JPY 360 billion) into Orsted, bringing its equity stake to 10%. With more than 70% of its revenue derived from offshore wind, Orsted was forced to halt its U.S. projects under construction in August 2025 due to the Trump administration’s anti-wind policy.

Meanwhile, BP of the United Kingdom and Japan’s JERA (a joint venture of Tokyo Electric Power and Chubu Electric Power) unified their offshore wind operations on September 8. By contrast, Mitsubishi Corporation announced its withdrawal from the offshore wind business on August 27, recording a loss of JPY 52.4 billion for the fiscal year ending March 2025.

In contrast to the retreat and stagnation of European and Japanese players in offshore wind power, Chinese manufacturers have been aggressively expanding into overseas markets—including the EU, BRICS countries, and nations along the Belt and Road Initiative—leveraging their advantages in price and technology. Chinese wind turbines are estimated to be 20–50% cheaper than those from Western manufacturers, supported by a unique mass-production system in which 60–70% of key components—such as foundations, blades, and generators—are produced domestically in China. China now accounts for over 50% of global offshore wind turbine production and is estimated to hold a 40–60% share of the global wind turbine market overall.

Solar power has also become a virtual monopoly for China. More than 90% of the world’s top 15 solar panel manufacturers are Chinese companies. China produces about 98% of the world’s silicon wafers (substrates), supplies over 85% of solar cells, and manufactures roughly 77% of modules (finished panels). As a result, more than 80% of global solar panel shipments are Chinese-made. In Japan as well, over 80% of solar panels shipped in 2024 were made in China. Did you know that?

Global production capacity for electric vehicle (EV) batteries has reached 3.4 times the level of demand, leaving the EV battery market in a state of oversupply. China controls about 70% of global EV battery production. Although governments in the United States, Japan, and other countries have promoted domestic battery production to reduce dependence on China for economic security reasons, the slowdown in EV demand has led many companies to scale back their investments. In contrast, Chinese manufacturers have continued to expand their investments, resulting in European automakers becoming increasingly dependent on Chinese battery suppliers. This trend raises the risk of widening gaps in production capacity and technological capabilities between China and the U.S., Japan, and Europe in the future.

The European Union, meanwhile, has positioned nuclear power as a cornerstone of energy security, as well as a key resource for achieving a carbon-neutral society and supporting economic stability. Japan, as a resource-scarce nation, must also overcome its long-standing “nuclear allergy” and reassess nuclear power, while strategically combining it with diverse decarbonized energy sources such as hydrogen and ammonia.

Japan’s Exclusive Economic Zone (EEZ), including the waters off the Ogasawara Islands, is rich in deep-sea resources such as methane hydrate (“flammable ice”), rare metals, rare-earth mud, and seafloor hydrothermal deposits. The development and utilization of these resources are regarded as critical strategies for Japan’s future energy security and economic growth.

Japan’s Exclusive Economic Zone (EEZ), including the waters off the Ogasawara Islands, is rich in deep-sea resources such as methane hydrate (“flammable ice”), rare metals, rare-earth mud, and seafloor hydrothermal deposits. The development and utilization of these resources are regarded as critical strategies for Japan’s future energy security and economic growth.

According to China’s National Bureau of Statistics, July economic data showed a 0.14% decline in retail sales from the previous month, marking the second consecutive monthly decrease after June. The impact of subsidies for replacing cars with electric vehicles (EVs) has waned, leading to a 1.5% drop in automobile-related sales. Restaurant revenue, which accounts for about 10% of total retail sales, managed only a modest 1.1% increase. The youth unemployment rate (ages 16–24) in July reached 17.8%, up 3.3 percentage points from June. With cost-cutting behavior spreading especially among young people—who normally have a high propensity to consume—consumption recovery cannot be expected unless their employment difficulties are resolved.

The real estate market also showed no improvement, with property developers’ investment falling by 12%. In addition, escalating tariff battles with the United States have put further strain on exporters and risk worsening the employment situation. In 2024, China’s crude steel output was around 1 billion tons, accounting for more than half of the world’s total crude steel production. China also holds a 50–70% global market share in solar power, wind power, and EV batteries. With excess production in steel, solar panels, wind turbines, EV batteries, and electric vehicles, Chinese companies have been flooding overseas markets with cheap exports, effectively reshaping global markets. The pressing question is whether we can successfully overcome this crisis. MJSA = Make Japan Strong Again!

From Threat to Awe: China’s Shipbuilding Power Surges Despite Regulatory Pressures

Then came a surprising piece of news from China. China State Shipbuilding Corporation (CSSC), the world’s largest shipbuilder, announced the merger of its two core subsidiaries—China State Shipbuilding Industry Corporation (CSIC) being absorbed into China Shipbuilding Corporation. CSSC’s revenue now exceeds RMB 130 billion (approximately JPY 2.7 trillion). In 2024, the two companies together secured new orders totaling 28.62 million deadweight tons (DWT), ranking first worldwide. By comparison, Japanese shipbuilders secured 10.08 million DWT in the same year—barely one-third of China’s total.

Although China’s shipbuilding industry had been expanding rapidly, new measures announced in May 2025 by the U.S. Trade Representative (USTR)—specifically, the imposition of port entry fees on Chinese-built vessels starting in October 2025—led to a decline in new orders. In response, CSSC appears to have pushed forward with this merger of its two core subsidiaries to eliminate inefficiencies and enhance productivity. Naturally, this move is thought to align with the policy direction of the Chinese government. China’s strategy of scale expansion goes far beyond our frame of thinking, as monumental as the Great Wall itself.

Container Freight Rates Fall for 12 Consecutive Weeks, Supply-Demand Imbalance Becomes Clear

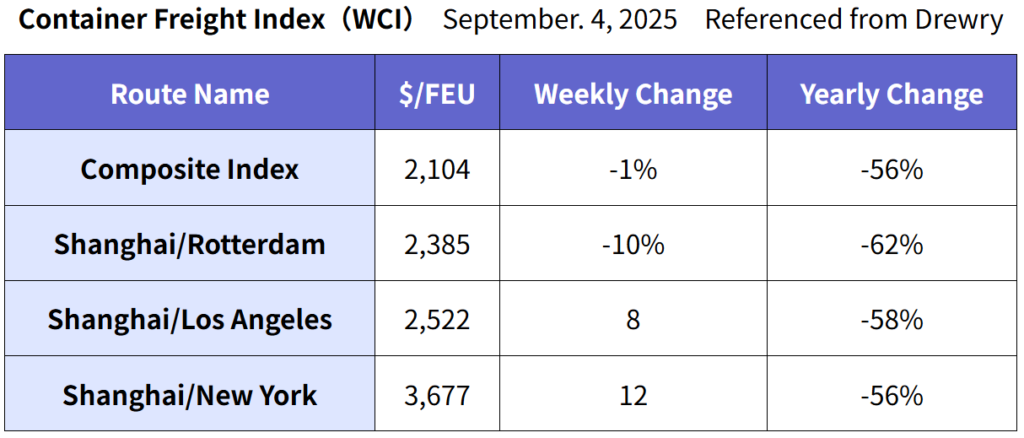

Drewry Container Freight Index

According to the latest Container Freight Index (WCI) released by Drewry on the 4th, the composite index fell by 1% from the previous week to USD 1,204 per FEU. This marked the 12th consecutive week of week-on-week declines. While rates to Europe and the Mediterranean continued to fall, U.S.-bound rates rose sharply for the first time in 12 weeks, narrowing the overall rate of decline. Drewry forecasts that supply-demand conditions will worsen in the latter half of this year, leading to a further decline in short-term container freight rates. In addition, 2.3 million TEU of new vessel capacity is scheduled for delivery this year, underscoring the fact that transport demand is failing to keep pace with the increase in vessel supply.

HMM, the World’s 8th Largest Carrier, Faces Renewed Turmoil Over Buyout Bids

In 2023, Korea Development Bank (KDB) and Korea Ocean Business Corporation (KOBC), which together hold more than 70% of HMM’s shares, conducted a bidding process for their stake. Hapag-Lloyd also submitted a bid, but was excluded because the sale was restricted to domestic Korean companies. Pan Ocean and the JKL Consortium were selected as the preferred negotiating partners, but talks eventually broke down and the process was reset. Recently, however, a new candidate has emerged: POSCO Group, South Korea’s leading steelmaker, which is reportedly considering becoming the largest shareholder. As of September 1, HMM operates 88 container vessels with a total capacity of 957,794 TEU, ranking it the eighth-largest liner shipping company in the world.

Newly Built Container Information—Production Declines, Export Demand Pauses

In August, the price of new containers fell to USD 1,650 per 20F, down USD 50, or 2.9%, from the previous month. The main factors were a 1% decline in steel prices and a nearly 13% drop in flooring material costs. Total container production in August was 611,066 TEU (Dry: 572,584 TEU; Reefer: 38,482 TEU). Compared to July, this represented a decrease of 93,265 TEU overall (Dry: -97,839 TEU; Reefer: +4,574 TEU), equivalent to a 13% decline (Dry: -15%; Reefer: +13%). Factory inventories of new containers at the end of August stood at 1,737,777 TEU (Dry: 1,678,071 TEU; Reefer: 59,706 TEU). This was an increase of 44,545 TEU from the previous month (Dry: +42,145 TEU; Reefer: +2,400 TEU), or 2.6% overall (Dry: +2.6%; Reefer: +4.2%). Factory shipments in August totaled 566,521 TEU (Dry: 530,439 TEU; Reefer: 36,082 TEU). Compared with the previous month, this was a decrease of 78,415 TEU (Dry: -74,432 TEU; Reefer: -3,983 TEU), representing a 12% decline overall (Dry: -12%; Reefer: -10%). Although summer is typically the peak season for exports, shipments from China in August appeared to have taken a breather.

Reefer Containers Hold the Key to Revitalizing Local Communities and Economy: Job Creation and Regional Development

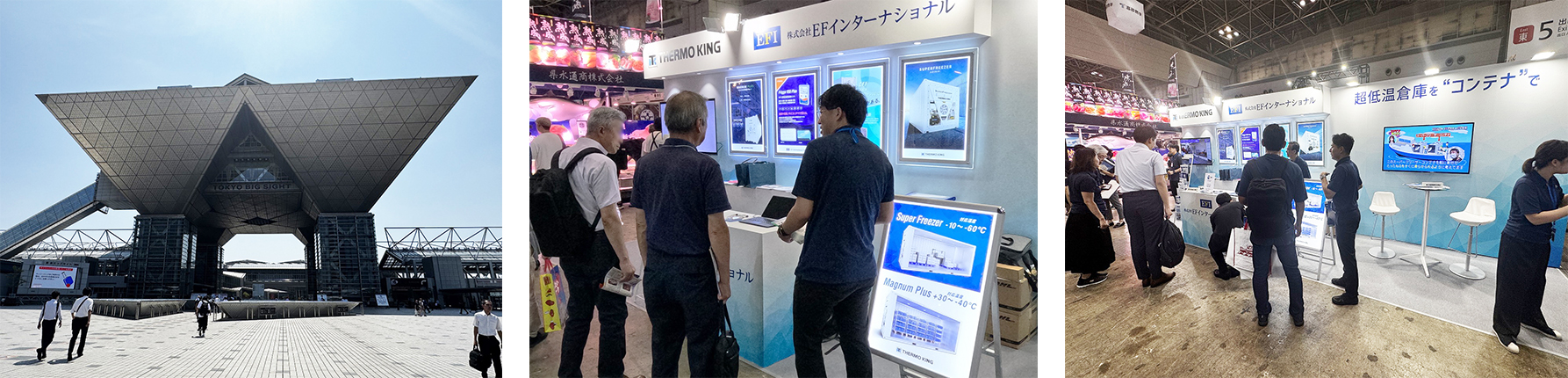

From August 20 (Wednesday) to 23 (Friday), the Japan International Seafood Show was held at Tokyo Big Sight. For the third consecutive year, our company co-exhibited with Thermo King. Last year, the three-day event welcomed 25,022 visitors; this year, attendance increased by 12% to 27,932. The Thermo King/EFI booth also attracted more visitors than last year and concluded with great success.

In my interview with industry media, I emphasized this year’s theme: “Reefer containers can revitalize local communities!” The reason is that Japan has approximately 2,866 fishing ports, large and small. The challenge I wish to highlight lies particularly with the 2,134 smaller ports used mainly by local fishermen, along with 99 ports on remote islands. Reefer containers can play a vital role in revitalizing these areas.

Freshly caught fish is usually auctioned off the same day or stored in cold storage facilities. But how many small fishing ports actually have cold storage warehouses? Constructing new facilities, or transporting catches to nearby warehouses, is hardly cost-effective. By contrast, a reefer container allows fishermen to preserve the value of seasonal fish, releasing them to the market later when their rarity commands higher prices. When two or three fishermen work together, they can share both the costs and the risks.

Once processing and sales of the catch begin, the fish gain added value, creating demand for labor and thereby generating employment. Retirees and housewives in local communities can be engaged, helping bring vitality back to the area. Fresh fish can be supplied directly to nearby inns, restaurants, and supermarkets, creating business opportunities. At the start, part-time labor is sufficient until the business takes off.

Reefer containers can also be used for storing processed products and, when necessary, can be moved to wherever they are needed. They can even be shipped overseas as-is, turning local ports into export gateways. As markets expand, more containers can be added to handle increased volumes, without being constrained by the scale or fixed location of a traditional cold storage facility. For those engaged in fish farming, reefer containers are also highly recommended, as they offer transparent cost management and ease of operation.

For anyone considering their use, we at EFI will provide careful training on handling methods. If problems arise, we will provide full support, so there is no need for concern. By adopting reefer containers, small fishing ports across Japan can highlight their unique local features, sparking initiatives in local production for local consumption. This can evolve into thriving fisheries and processing industries, creating interconnected regional economies across villages, towns, and cities. Ultimately, this will deliver a substantial economic impact nationwide. For our island nation, Japan, there is no doubt that reefer containers will brighten the future.

(Translated by Y. Tokuyama)