Headlines

- 1 Distortions Created by Trump’s Policies – A Strong Wealthy Class and a Shaky U.S. Economy

- 2 BYD’s Rapid Advance in Europe – Changing the Face of the Global Automotive Market?

- 3 Massive Port Entry Fees, Yet No Freight Rate Hikes – Global Carriers’ Gambit?

- 4 Retail Imports at Major U.S. Ports Expected to Fall Below Last Year’s Throughout the Year

- 5 China Opens Its First Arctic Shipping Route to Europe – Transit Time Cut in Half to 18 days

- 6 Container Freight Rates Fall for 16 Consecutive Weeks – Alliances Accelerate Blank Sailing Strategies

- 7 Newly Built Container Information in October 2025 – Export Slowdown and Inventory Declines Toward Year-End

- 8 First Female Prime Minister !? and Two Straight Years of Nobel Prizes Bring Renewed Hope for Japan’s Future

Distortions Created by Trump’s Policies – A Strong Wealthy Class and a Shaky U.S. Economy

According to preliminary data released by the U.S. Department of Commerce on September 16, U.S. retail sales in August, seasonally adjusted, rose by 0.6% from the previous month, marking the third consecutive monthly increase. Despite growing signs of an economic slowdown caused by price hikes stemming from President Trump’s tariff policies, persistently high interest rates, and a weakening labor market, personal consumption has shown little sign of decline. Analysts attribute this resilience to the unexpectedly strong spending power of high-income households. While wealthier consumers have benefited from rising stock prices and accumulated greater savings, low-income and younger groups appear to be bearing the brunt of deteriorating labor conditions.

According to preliminary data released by the U.S. Department of Commerce on September 16, U.S. retail sales in August, seasonally adjusted, rose by 0.6% from the previous month, marking the third consecutive monthly increase. Despite growing signs of an economic slowdown caused by price hikes stemming from President Trump’s tariff policies, persistently high interest rates, and a weakening labor market, personal consumption has shown little sign of decline. Analysts attribute this resilience to the unexpectedly strong spending power of high-income households. While wealthier consumers have benefited from rising stock prices and accumulated greater savings, low-income and younger groups appear to be bearing the brunt of deteriorating labor conditions.

On September 17, the U.S. Federal Reserve (FRB) decided to cut interest rates by 0.25%—its first rate reduction in nine months. Due to the uncertainty surrounding the economy brought about by President Trump’s tariff policies, many companies have been holding back on capital investment, redirecting their excess funds into financial markets instead. However, if this monetary easing fails to stimulate the real economy, there is a growing risk that financial markets could cool down as investment returns decline.

On September 30, the U.S. government ended its subsidy program for electric vehicle (EV) purchases. This represents a major setback for the market, as the prices of Tesla’s main models are expected to rise by around 20%. President Trump, who has taken a skeptical stance toward decarbonization, also terminated tax credits for leased and used EVs at the end of September, extending the measure to include non–North American–made vehicles as well.

On October 1, the expiration of the U.S. federal budget led to a partial government shutdown, with approximately 750,000 federal employees expected to be temporarily furloughed. President Trump is believed to be using this standoff to pressure the Democratic Party—demanding cuts in social security spending and greater efficiency in programs such as low-income medical insurance subsidies related to the Affordable Care Act (Obamacare)—as part of a broader strategy to gain an advantage in the midterm elections next November.

However, prolonged reductions in government spending could shrink regional economic activity by more than USD 1 billion per month. Meanwhile, a cryptocurrency company established by President Trump and his son has grown rapidly under deregulation, raising the Trump family’s total assets to an estimated JPY 1.1 trillion.

The dismissal of independent agency heads, the unauthorized deployment of National Guard units to Los Angeles and Chicago under the pretext of maintaining public order, and the use of military parades on his birthday for personal glorification all project an authoritarian image reminiscent of a dictatorship. Such displays of power have caused deep turmoil within American society, and it is reasonable to expect that the repercussions will ultimately rebound upon the unconventional President Trump himself.

BYD’s Rapid Advance in Europe – Changing the Face of the Global Automotive Market?

According to the German Federal Employment Agency, the number of unemployed persons in August reached 3.025 million, surpassing the three-million mark for the first time since February 2015. Rising energy costs have hit Germany’s manufacturing sector—which accounts for roughly 20% of the nation’s GDP—particularly hard, triggering a wave of corporate restructuring and layoffs. During the one-year period through June 2025, more than 50,000 jobs were eliminated in Germany’s automotive industry, accounting for about 45% of all job cuts across the country’s industrial sector. Faced with declining exports and weakening competitiveness, German automakers are increasingly alarmed about the sustainability of their industry. Meanwhile, Chinese automakers are expanding their presence in Europe. China’s leading electric vehicle manufacturer BYD has been aggressively increasing the number of its dealerships, stepping up its push into the European market.

According to the German Federal Employment Agency, the number of unemployed persons in August reached 3.025 million, surpassing the three-million mark for the first time since February 2015. Rising energy costs have hit Germany’s manufacturing sector—which accounts for roughly 20% of the nation’s GDP—particularly hard, triggering a wave of corporate restructuring and layoffs. During the one-year period through June 2025, more than 50,000 jobs were eliminated in Germany’s automotive industry, accounting for about 45% of all job cuts across the country’s industrial sector. Faced with declining exports and weakening competitiveness, German automakers are increasingly alarmed about the sustainability of their industry. Meanwhile, Chinese automakers are expanding their presence in Europe. China’s leading electric vehicle manufacturer BYD has been aggressively increasing the number of its dealerships, stepping up its push into the European market.

According to an analysis by The Nikkei, China’s real GDP for the July–September 2025 quarter is projected to grow by an average of 4.6% year-on-year. This marks a slowdown from the 5.2% increase recorded in the April–June quarter, as government stimulus measures to boost consumption appear to be losing momentum and domestic demand remains sluggish.

Meanwhile, Bloomberg reported on October 4 that China is seeking a relaxation of U.S. restrictions in exchange for committing to large-scale investments in the United States, citing national security considerations. China has also reportedly requested tariff reductions on Chinese-made products used in factories that Chinese companies plan to build in the U.S. While Beijing initially proposed a U.S. investment package totaling USD 1 trillion in early 2025, the current scale of the offer remains unclear. For now, both China and the U.S. have partially suspended some of their mutual tariffs until November 10.

On October 1, China’s major automaker BYD announced that its new vehicle sales in September fell by 6% year-on-year to 396,270 units—the first year-on-year decline in 19 months. Although overseas sales continued to grow, the company is struggling in the domestic market, facing fierce competition from both established private automaker Geely Automobile and emerging EV manufacturer Leapmotor.

Massive Port Entry Fees, Yet No Freight Rate Hikes – Global Carriers’ Gambit?

Beginning October 14, the Office of the United States Trade Representative (USTR) will impose a port entry fees on vessels which Chinese-owned , operated, or built in China that call at U.S. ports. According to estimates by France-based AXS-Alphaliner, the total port entry fees for major shipping lines in 2026—covering both Chinese-owned and Chinese-built vessels—are expected to reach USD 3.2 billion (approximately JPY 470 billion). China’s state-owned COSCO Group, including its subsidiary OOCL, will bear nearly half of that amount, around USD 1.53 billion. By comparison, the estimated annual costs for other major carriers are: Maersk – USD 17.5 million, Hapag-Lloyd – USD 105 million, MSC – USD 240 million, ONE – USD 363 million, CMA CGM – USD 335 million, and Yang Ming – USD 130 million. Evergreen and HMM are expected to face no additional charges.

The top five global carriers have announced that they do not plan to pass these additional costs on to shippers through freight rate surcharges. Likewise, COSCO and OOCL have stated that they will also refrain from imposing any rate adjustments. Most shipping lines are now removing China-built vessels from U.S. service routes, reorganizing their fleet deployment, and switching leasing sources to mitigate the impact. Nevertheless, there is no doubt that this new measure will significantly erode profitability across the liner shipping industry.

On October 3, the U.S. Customs and Border Protection (CBP) issued a notice regarding the payment procedures for the new port entry fees. According to the announcement, payments must be completed no later than three days before the vessel arrives at a U.S. port. CBP clarified that the responsibility for determining whether a vessel is subject to the entry fees lies with the vessel operator, not with CBP. All payments must be made through the U.S. Department of the Treasury’s online platform, Pay.gov. Furthermore, CBP stated that any vessel for which proof of payment is not confirmed within the associated Vessel Entrance and Clearance System (VECS) will not be permitted to conduct cargo operations until verification is completed. In some cases, customs clearance procedures may also be suspended until payment confirmation is obtained.

Retail Imports at Major U.S. Ports Expected to Fall Below Last Year’s Throughout the Year

On September 9, the National Retail Federation (NRF) released the latest data and projections for retail-related imports through major U.S. ports. The forecast for August was revised upward by 80,000 TEU to 2.28 million TEU, representing a 1.7% decrease compared with the same month last year. For September, NRF now expects a 6.8% year-on-year decline to 2.12 million TEU—an upward revision of 290,000 TEU from the previous forecast. For the months ahead, import volumes are projected as follows: October – down 13.2% to 1.95 million TEU (revised up by 130,000 TEU); November – down 19.7% to 1.74 million TEU (up by 30,000 TEU); December – down 20.1% to 1.70 million TEU (revised down by 20,000 TEU); and January 2026 – down 19.1% to 1.80 million TEU.

China Opens Its First Arctic Shipping Route to Europe – Transit Time Cut in Half to 18 days

China is opening a new container shipping route to Europe via the Arctic Sea. In late September, the Istanbul Bridge, operated by Chinese shipping company Sea Legend, departed from Ningbo Port in Zhejiang Province. The vessel will transit through the Bering Strait, cross the Arctic waters off Russia, and reach the Port of Felixstowe—the U.K.’s largest container terminal—in about 18 days. By contrast, the traditional “southern route,” which passes through the Strait of Malacca, the Red Sea, and the Suez Canal, takes more than 40 days, while the China–Europe Railway Express that runs through Central Asia requires over 25 days. Although the Arctic route is navigable only during the summer and autumn months when sea ice is thinner, global warming has been steadily shrinking the extent of the ice-covered area. In response to the Trump administration’s tariff hikes on Chinese goods, Beijing aims to expand its trade with Europe by utilizing this northern route. The initiative forms part of President Xi Jinping’s Belt and Road strategy—specifically, the development of a so-called “Ice Silk Road.”

China is opening a new container shipping route to Europe via the Arctic Sea. In late September, the Istanbul Bridge, operated by Chinese shipping company Sea Legend, departed from Ningbo Port in Zhejiang Province. The vessel will transit through the Bering Strait, cross the Arctic waters off Russia, and reach the Port of Felixstowe—the U.K.’s largest container terminal—in about 18 days. By contrast, the traditional “southern route,” which passes through the Strait of Malacca, the Red Sea, and the Suez Canal, takes more than 40 days, while the China–Europe Railway Express that runs through Central Asia requires over 25 days. Although the Arctic route is navigable only during the summer and autumn months when sea ice is thinner, global warming has been steadily shrinking the extent of the ice-covered area. In response to the Trump administration’s tariff hikes on Chinese goods, Beijing aims to expand its trade with Europe by utilizing this northern route. The initiative forms part of President Xi Jinping’s Belt and Road strategy—specifically, the development of a so-called “Ice Silk Road.”

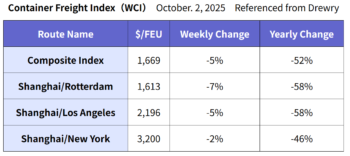

Container Freight Rates Fall for 16 Consecutive Weeks – Alliances Accelerate Blank Sailing Strategies

The latest Drewry World Container Index (WCI), released on October 2, showed that the composite index fell by 5% from the previous month to USD 1,669 per FEU, marking the 16th consecutive weekly decline. With China observing its eight-day National Day holiday from October 1 to 8, major container carriers have been adjusting capacity by suspending certain services to balance supply and demand. Some alliances have also announced plans to continue partial service suspensions even after the holiday period. However, if weak demand persists, there is concern that the scope of these suspensions could expand further in the coming weeks.

Newly Built Container Information in October 2025 – Export Slowdown and Inventory Declines Toward Year-End

The average price of newly built containers in September remained unchanged from August at USD 1,650 per 20ft. Although the prices of steel materials and flooring boards declined, overall container prices were stable. Total production volume in September decreased compared with the previous month (with a decline in dry containers and an increase in reefers), while factory shipments rose by 9% month-on-month. Reefer production increased, though the number of units shipped from factories did not grow as strongly.

In September, total container production reached 584,841 TEU (Dry: 542,083 TEU; Reefer: 42,758 TEU). Compared with August, production fell by 26,225 TEU (Dry: –30,501 TEU; Reefer: +4,276 TEU), representing a 4% decrease overall (Dry: –5%; Reefer: +11%). Factory inventory at the end of September totaled 1,703,156 TEU (Dry: 1,648,151 TEU; Reefer: 55,005 TEU), down 34,621 TEU from August (Dry: –29,920 TEU; Reefer: –4,701 TEU), equivalent to a 2% decline overall (Dry: –2%; Reefer: –8%).

Total factory shipments in September reached 619,462 TEU (Dry: 427,997 TEU; Reefer: 47,459 TEU), an increase of 52,941 TEU from the previous month (Dry: –102,442 TEU; Reefer: +11,377 TEU), or 9% up overall (Dry: –19%; Reefer: +32%). As in previous years, export activity increased ahead of China’s National Day holiday. However, given the decline in both production volume and factory inventory, exports from China are expected to lose momentum toward the end of the year.

First Female Prime Minister !? and Two Straight Years of Nobel Prizes Bring Renewed Hope for Japan’s Future

On Saturday, October 4, Sanae Takaichi was elected as the new president of Japan’s ruling Liberal Democratic Party (LDP), becoming the first lady to hold this position since the party’s founding in 1955. She is expected to be formally appointed as Japan’s first female prime minister during an extraordinary Diet session convened on Wednesday, October 15. Without belonging to any faction, it is exceptionally difficult for a politician like Ms. Takaichi to rise to leadership within Japan’s political establishment. Her victory therefore reflects the strong public and party-wide expectations for the revitalization of both the LDP and the nation itself. Many hope that Ms. Takaichi will demonstrate decisive leadership and help bring about a transformation in Japan’s politics—and in the mindset of the Japanese people.

On Saturday, October 4, Sanae Takaichi was elected as the new president of Japan’s ruling Liberal Democratic Party (LDP), becoming the first lady to hold this position since the party’s founding in 1955. She is expected to be formally appointed as Japan’s first female prime minister during an extraordinary Diet session convened on Wednesday, October 15. Without belonging to any faction, it is exceptionally difficult for a politician like Ms. Takaichi to rise to leadership within Japan’s political establishment. Her victory therefore reflects the strong public and party-wide expectations for the revitalization of both the LDP and the nation itself. Many hope that Ms. Takaichi will demonstrate decisive leadership and help bring about a transformation in Japan’s politics—and in the mindset of the Japanese people.

On Tuesday, October 7, it was announced that Professor Shimon Sakaguchi (age 74), Distinguished Professor at Osaka University, had been awarded the 2025 Nobel Prize in Physiology or Medicine. Following the 2024 Nobel Peace Prize awarded to the Japan Confederation of A- and H-Bomb Sufferers Organizations, or Nihon Hidankyo, this marks the second consecutive year that a Japanese recipient has been honored with a Nobel Prize—something of which we, as Japanese people, can be immensely proud. Then, to our further astonishment, a day later on the evening of October 8, Professor Susumu Kitagawa (age 74) of Kyoto University’s Institute for Advanced Study was announced as the winner of the Nobel Prize in Chemistry. Watching his interview alongside his wife, I was deeply moved to learn how her support had been indispensable to his achievement. I found this sentiment personally resonant—and entirely convincing. As someone of the same generation, I feel profound gratitude and admiration for both laureates. I sincerely hope that those in their seventies who remain active and energetic will continue contributing to Japan for as long as they can. Our generation still has much to offer, and I am confident that their accomplishments will serve as a powerful inspiration to the younger generations of Japan. I firmly believe that the Japanese people can continue to make meaningful contributions to world peace.