Headlines

- 1 The Shock of Trump Tariffs: How Japan and the EU Responded Amid U.S.–China Tensions

- 2 China’s EV Push and Steel Dominance Force Strategic Review in Western Manufacturing

- 3 Tariff Measures Deferred at the U.S.–China Summit, Yet Rising Shipping Costs Unavoidable

- 4 Red Sea Attacks Resume: Carriers Remain Cautious Amid the Suez–Cape Routing Dilemma

- 5 Fleet Oversupply Risks Intensify Strategies to Raise Market Share by increasing Owned-Vessel Ratios

- 6 A Wave of Mergers Among Leasing Giants: The Battle for Global No. 1 Accelerates

- 7 Newbuilt Containers Information – December 2025

- 8 Freight Index Rises 7% Ahead of Full-negotiation for Next Year’s Service Contracts

- 9 Be Grateful to Yourself: Joy of fulfillment by Steady Daily Efforts

The Shock of Trump Tariffs: How Japan and the EU Responded Amid U.S.–China Tensions

2025 was a year in which shipping lines, container manufacturers, and leasing companies around the world were thrown into turmoil by President Trump’s uncompromising tariff policies. Both Japan and the EU pledged substantial investments in the United States in an effort to minimize the impact of these tariffs. Japan committed to investing USD 550 billion (approximately JPY 80 trillion) by January 2029, while the EU pledged around USD 600 billion in U.S. investments and secured up to EUR 800 billion for defense strengthening and rearmament.

2025 was a year in which shipping lines, container manufacturers, and leasing companies around the world were thrown into turmoil by President Trump’s uncompromising tariff policies. Both Japan and the EU pledged substantial investments in the United States in an effort to minimize the impact of these tariffs. Japan committed to investing USD 550 billion (approximately JPY 80 trillion) by January 2029, while the EU pledged around USD 600 billion in U.S. investments and secured up to EUR 800 billion for defense strengthening and rearmament.

Meanwhile, the United States and China engaged in repeated rounds of retaliatory tariffs, at the U.S.–China summit held in South Korea at the end of October, the two sides agreed to a one-year extension of the enforcement through November 10, 2026. However, in May, the U.S. Court of International Trade (CIT) ruled portions of the Trump tariffs unlawful, and the Federal Circuit upheld that decision. As a result, the matter now awaits a final ruling by the U.S. Supreme Court on its constitutionality and legality. In the meantime, companies from various countries have filed lawsuits against the U.S. government seeking refunds of the unlawfully imposed duties.

China’s EV Push and Steel Dominance Force Strategic Review in Western Manufacturing

Because President Trump is skeptical of decarbonization initiatives, the U.S. ended its EV purchase subsidies on September 30, causing the prices of Tesla’s main models to rise by roughly 20 percent.

In Germany, the number of unemployed reached 3.025 million in August, surpassing the three-million mark for the first time since 2015. Elevated energy costs have dealt a direct blow to Germany’s manufacturing sector, which accounts for about 20% of the country’s GDP. Over the twelve months to June 2025, the German automotive industry cut around 50,000 jobs, representing 45% of all workforce reductions across German industry. Facing declining export volumes and a weakening competitive edge, German automakers are increasingly alarmed about their future prospects. As of June 2025, Chinese-brand EVs had captured an 11% market share in Europe. Although European automakers had decisively shifted toward EV strategies, they now find themselves compelled to scale back temporarily and explore a renewed focus on internal combustion engine vehicles (HV) as a viable path to recovery.

China produces roughly 1 billion tons of crude steel, accounting for more than half of global output. It also dominates global markets in solar power equipment, wind turbines, and EV batteries, with market shares ranging from 50% to 70%. These sectors, along with steel and EVs, now face oversupply in China, triggering Chinese companies to launch aggressive low-price campaigns in overseas markets. However, despite government stimulus measures that have so far prevented a sharp economic downturn, China’s economy has not achieved a full-fledged recovery. Deflationary pressures, stagnant exports, and ongoing weaknesses in the property and labor markets continue to weigh heavily on growth.

In February, the U.S. Trade Representative (USTR) determined that China’s dominant position in the shipping, logistics, and shipbuilding sectors constituted an unfair trade practice, and announced retaliatory measures under Section 301 of the U.S. Trade Act. Subsequently in April, the U.S. released detailed port-entry fees targeting vessels operated or owned by Chinese shipping lines calling at American ports, as well as additional port charges on China-built vessels. Although Chinese shipping lines are the primary target, the fact that many global carriers also operate large fleets of China-built vessels means higher maritime transport costs for the industry as a whole. Nonetheless, at the U.S.–China summit held in South Korea at the end of October, both sides agreed to postpone the implementation of these measures for one year, until November next year.

Negotiations over the labor agreement between the International Longshoremen’s Association (ILA), representing port workers on the U.S. East Coast and Gulf Coast, and the U.S. Maritime Alliance (USMX), representing port operators, reached a conclusion in January 2025. Following a three-day strike in October 2024, the two parties agreed on a new six-year contract, successfully averting further labor disruptions.

Red Sea Attacks Resume: Carriers Remain Cautious Amid the Suez–Cape Routing Dilemma

In January this year, a temporary ceasefire between Israel and Hamas prompted Yemen’s Houthi rebels to halt attacks on commercial vessels transiting the Red Sea. However, after Israel conducted strikes on Iran in June, the Houthis resumed attacks in early July. CMA CGM began transiting the Suez Canal again from late June under escort by the French Navy, but it is widely expected that most major carriers will continue to rely on the Cape of Good Hope routing for the time being.

In January this year, a temporary ceasefire between Israel and Hamas prompted Yemen’s Houthi rebels to halt attacks on commercial vessels transiting the Red Sea. However, after Israel conducted strikes on Iran in June, the Houthis resumed attacks in early July. CMA CGM began transiting the Suez Canal again from late June under escort by the French Navy, but it is widely expected that most major carriers will continue to rely on the Cape of Good Hope routing for the time being.

For major shipping lines, passage through the Suez Canal offers significant advantages—namely lower operating costs and shorter lead times compared with the Cape route. Yet, with 6–10% of global container ship capacity currently absorbed by detours around the Cape of Good Hope, any resumption of large-scale Suez operations would require several months to reallocate vessels. During this transition period, carriers would face operational disruptions as well as heightened freight-rate competition stemming from an increase in available vessel supply. As a result, leading carriers remain cautious about fully shifting back to the Suez route.

As of early 2025, the global container ship orderbook was reported at approximately 780 vessels, totaling 8.5 million TEU. Between 2025 and 2028, an annual average of around 1.9 million TEU of new tonnage is expected to be delivered, with a peak of roughly 2.2 million TEU slated for 2027. Although this surge in new capacity will inevitably place downward pressure on freight rates, carriers’ strategies aimed at renewing aging fleets, increasing the share of owned vessels, reducing dependence on chartered tonnage, and ultimately preserving market share and pricing power, continue to fuel an intense competitive race in newbuilding orders.

In February, a realignment of alliances took place, resulting in four major groups, i.e., 3 Alliances and one independent: Ocean Alliance, Gemini, Premia Alliance, and Swiss based MSC. In April, MSC became the first carrier in history to reach 900 operating vessels, consisting of 609 owned ships and 291 chartered vessels. The MSC Group’s total deployed capacity now stands at approximately 6.47 million TEU, exceeding that of second-ranked Maersk by nearly 1 million TEU. MSC alone accounts for 20.3% of global container shipping capacity. Furthermore, with 132 newbuildings firmly on order, the group’s fleet size is expected to surpass 1,000 vessels within the next few years.

A Wave of Mergers Among Leasing Giants: The Battle for Global No. 1 Accelerates

How large the China’s last-minute export surge ahead of the U.S. high-tariff implementation is also appeared in new container production and monthly shipment volumes at Chinese factories.

How large the China’s last-minute export surge ahead of the U.S. high-tariff implementation is also appeared in new container production and monthly shipment volumes at Chinese factories.

Total production for the ten months through October 2025 reached 5.4 million TEU, averaging over 500,000 TEU per month. This figure is close to the 6.6 million TEU produced in 2021, the second-highest year on record driven by pandemic-related stay-at-home demand, making 2025 the third-highest production year of the past decade.

Major container leasing companies maintained exceptionally high utilization rates throughout the year, generally ranging from 95% to 99%. Triton, the world’s largest lessor with a fleet of 7 million TEU, acquired GCI in March. In addition, Sumitomo Mitsui Finance and Leasing (SMFL) established a joint venture with Triton’s parent company, Brookfield, and purchased around 20% of Triton’s fleet (approximately 1.4 million TEU) as part of its entry into the container leasing business.

In May, Textainer, the world’s second-largest leasing company with 4.5 million TEU, announced its acquisition of Seaco, which owns 2.5 million TEU. As a result, Textainer’s total fleet will expand to 7 million TEU, overtaking Triton—after its divestment of 1.4 million TEU to SMFL—to become the world’s largest leasing company. Seaco, one of the long-established names in the industry dating back to the 1970s, disappearing from the leasing landscape so that the sector is advanced for further consolidation. Furthermore, in October, leading U.S. investment firm KKR committed USD 500 million (approximately JPY 77 billion) to a new leasing venture, Galaxy Container Solutions, marking its entry into the container leasing market.

Newbuilt Containers Information – December 2025

The price of newly built containers in November stood at USD 1,550 per 20ft, a decrease of USD 50 from the previous month, representing a 3.1% decline. Total production reached 445,582 TEU (Dry: 403,260 TEU, Reefer: 42,322 TEU). Compared with the previous month, this represents an increase of 48,926 TEU overall (Dry: +46,741 TEU; Reefer: +2,185 TEU), or +12.3% in total production (Dry: +13.1%; Reefer: +5.4%). Factory inventory levels at the end of October were 1,679,222 TEU (Dry: 1,605,297 TEU, Reefer: 73,925 TEU). Compared with the previous month, inventories increased by 11,631 TEU in total (Dry: +1,313 TEU; Reefer: +12,944 TEU), corresponding to a +1% rise overall (Dry: ±0%; Reefer: +21.2%). November factory shipments totaled 433,951 TEU (Dry: 404,573 TEU, Reefer: 29,378 TEU). Relative to October, shipments increased marginally by 1,730 TEU in total (Dry: +6,513 TEU; Reefer: –4,783 TEU), representing approximately ±0% overall (Dry: +1.6%; Reefer: –14%).

The decline in new container prices was driven largely by falling flooring material costs. Although total shipments remained unchanged, Dry containers increased while Reefer volumes declined. As a result, Dry inventory fell whereas Reefer inventory rose—a trend likely attributable to last-minute demand ahead of the U.S.–China summit held at the end of October.

Freight Index Rises 7% Ahead of Full-negotiation for Next Year’s Service Contracts

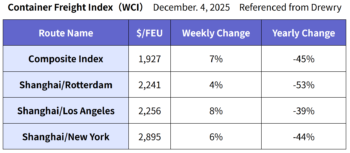

On December 4, Drewry released its latest container freight rate index.

The World Container Index (WCI) rose for the first time in four weeks, with the composite index increasing 7% week-on-week to USD 1,927 per FEU. All five major Shanghai-origin routes to Europe and North America recorded gains. Major carriers have shortened the cycle of short-term rate increases from biweekly adjustments to weekly increases, which Drewry believes will help stabilize the market.

With comprehensive service contract negotiations set to begin early next year, carriers are pushing to lift short-term rates, placing upward pressure on overall freight levels. On the other hand, Drewry notes that if the Suez Canal were to fully reopen, vessels currently absorbed on Cape of Good Hope routings would re-enter the market, potentially leading to overcapacity and downward pressure on rates. However, Drewry also points out that next year’s network restructurings across the major alliances could result in port congestion, which may offset some of the oversupply impact, limiting the extent of downward pressure on freight rates.

Be Grateful to Yourself: Joy of fulfillment by Steady Daily Efforts

As I grow older, I am reminded ever more strongly of the importance of steady, everyday effort. Or perhaps it is precisely because of my age that such daily commitment has become indispensable. Even small efforts, certain moments, I have a feeling that my daily efforts are rewarded. The joy of fulfillment that comes at such times is truly irreplaceable. And it may well be that I continue to put in the daily work for the sake of experiencing that very emotion. As the saying goes, Rome was not built in a day. There is still much to be done, and I intend to move forward step by step, with a firm and steady pace. I hope that younger generations, too, will come to experience that same sense of joy and to understand that sincere effort does bring rewards. I want them to know that hard work is indeed rewarded not by others, but by one’s own sense of gratitude toward oneself. I cannot allow myself to fall behind the younger members of our team. No! rather than competing with them, I hope to continue striving so that I may serve as a model for them.

Wishing all of you a wonderful New Year!